Gulaq Gear 3 Quant

This is a growth oriented portfolio that allocates capital to equity and debt at low volatility.

CAGR Since launch

Since May 2020

Since May 2020

19.8%

Overview

This portfolio follows a directional strategy that aims to consistently outperform the benchmark equity index while maintaining low volatility. It is a quantitatively managed fund that implements a systematic rule-based trading model to remove human subjectivity.

- Directional Strategy in Indian Equities

- Systematic Rule Based Trading

- Identifying Investable businesses in S&P BSE 500

- Agnostic to Sector and Market Capitalization

- Identify stocks using a combination of technical and fundamental factors

- Optimize the portfolio for maximizing risk rated returns

- Allocate capital to equities on basis of market valuations

Why should you invest in this portfolio

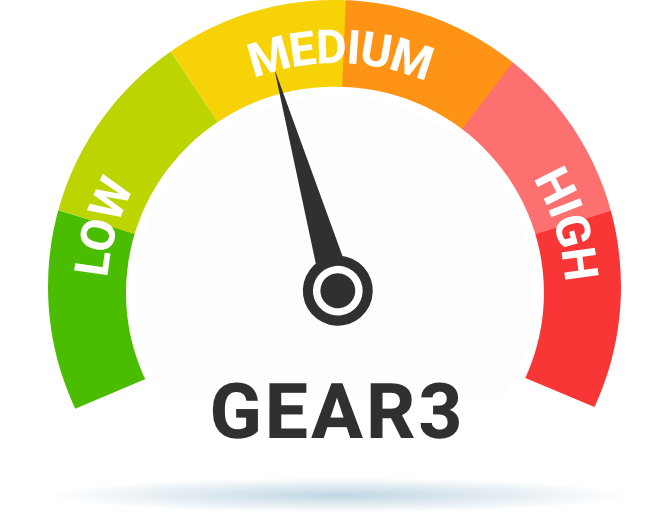

- Growth oriented portfolio for conservative to moderate investors

- Equity allocation 40%

- Debt allocation 60%

- Rebalanced monthly

Minimum Investment Amount

₹ 80,000

Download key points about this smallcase portfolio

Exclusive portfolio available only for subscribers.

See plans

3 Months – ₹1,900

6 Months – ₹2,900

Exclusive portfolio available only for subscribers.

See Plans

3 Month – ₹1,900

6 Month – ₹2,900