Why Gulaq?

Free Portfolio Report

Smart Optimization Tips

100% Secure. Your Data Stays Private

Quant powered Buy Sell Recommendation

(Coming Soon)

AI Assistant

Mutual Funds Capital Gains Report

Track and download your capital gains across all mutual fund platforms — in one place.

Mutual Funds Capital Gains Report

Track and download your capital gains across all mutual fund platforms — in one place.

X-Ray of Your Portfolio

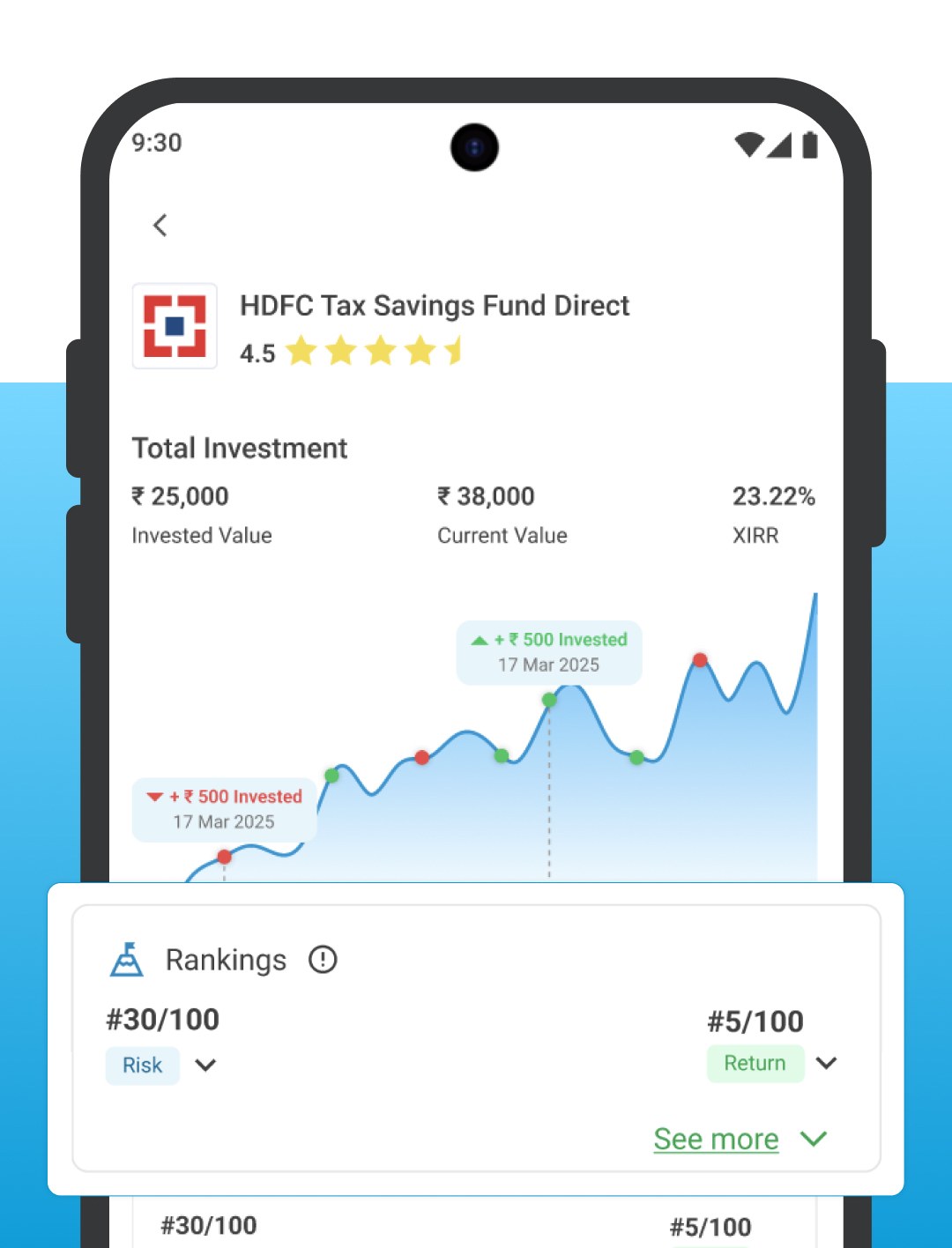

Find Your Mutual Fund’s True Ranking!

Find out how funds in your portfolio rank in terms on risk, returns, and expenses!

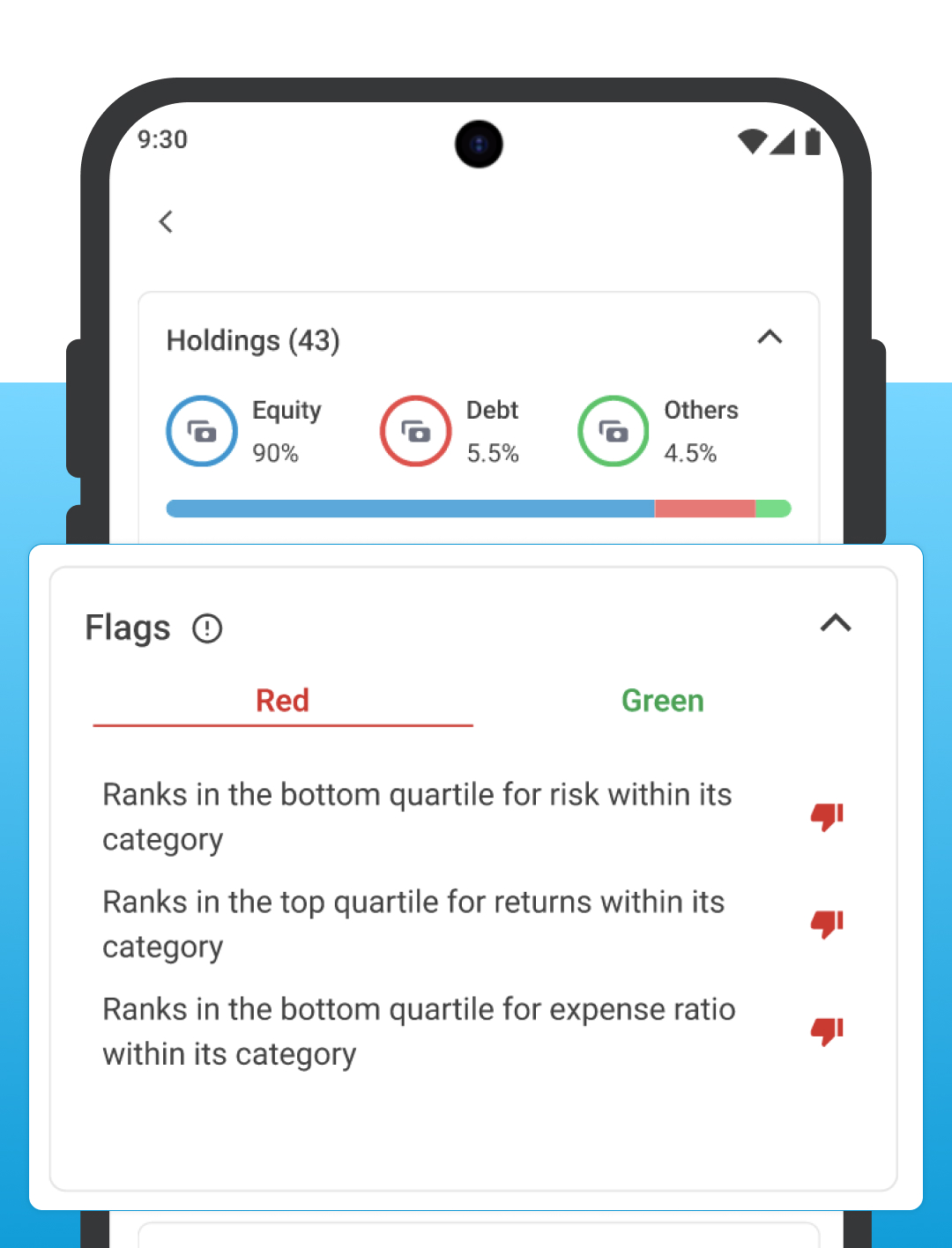

Are there hidden red flags in your mutual funds?

Instantly identify strengths and weaknesses in your portfolio.

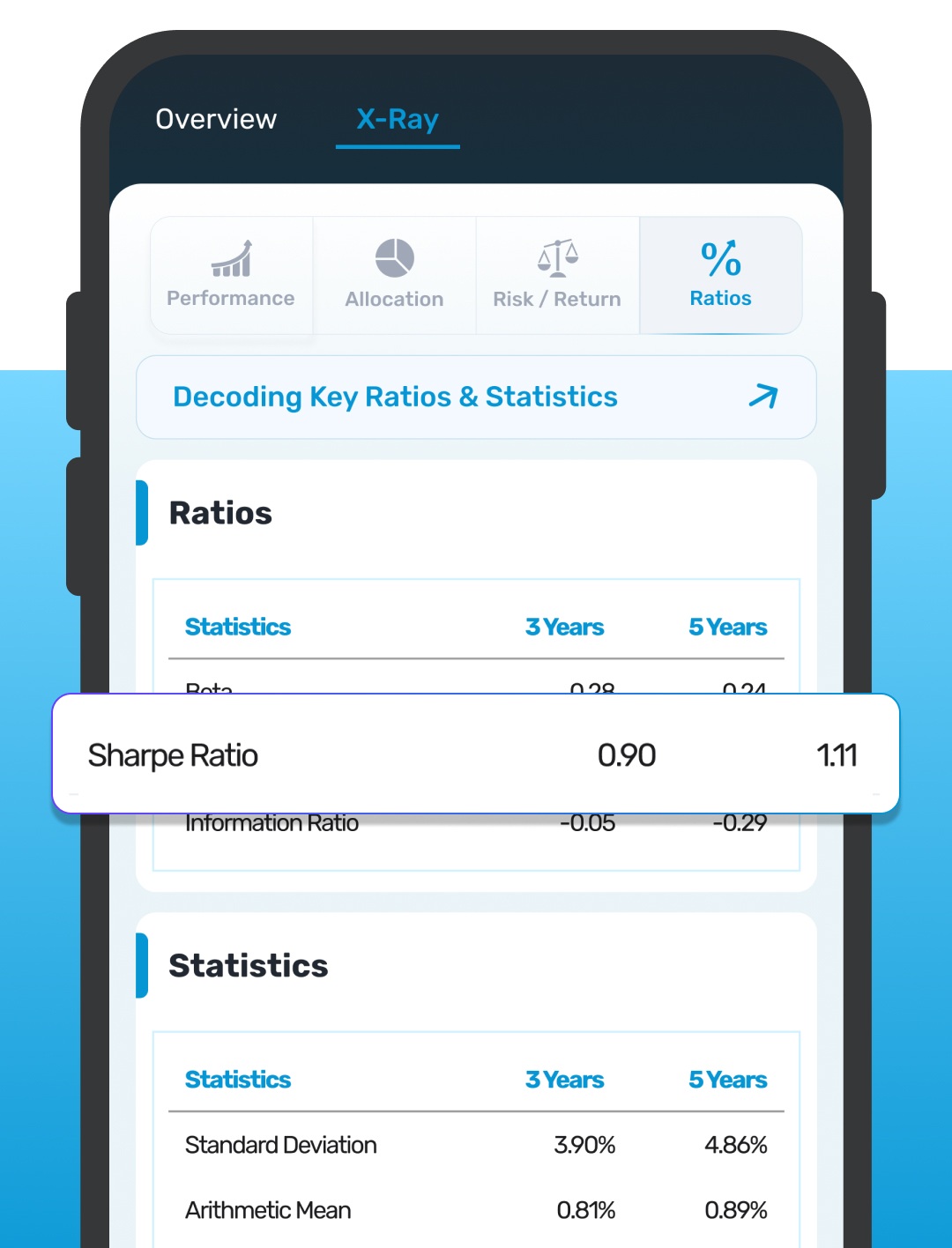

Key Portfolio Ratios

See efficiently your portfolio generates returns for the risk taken, using key risk-adjusted metrics.

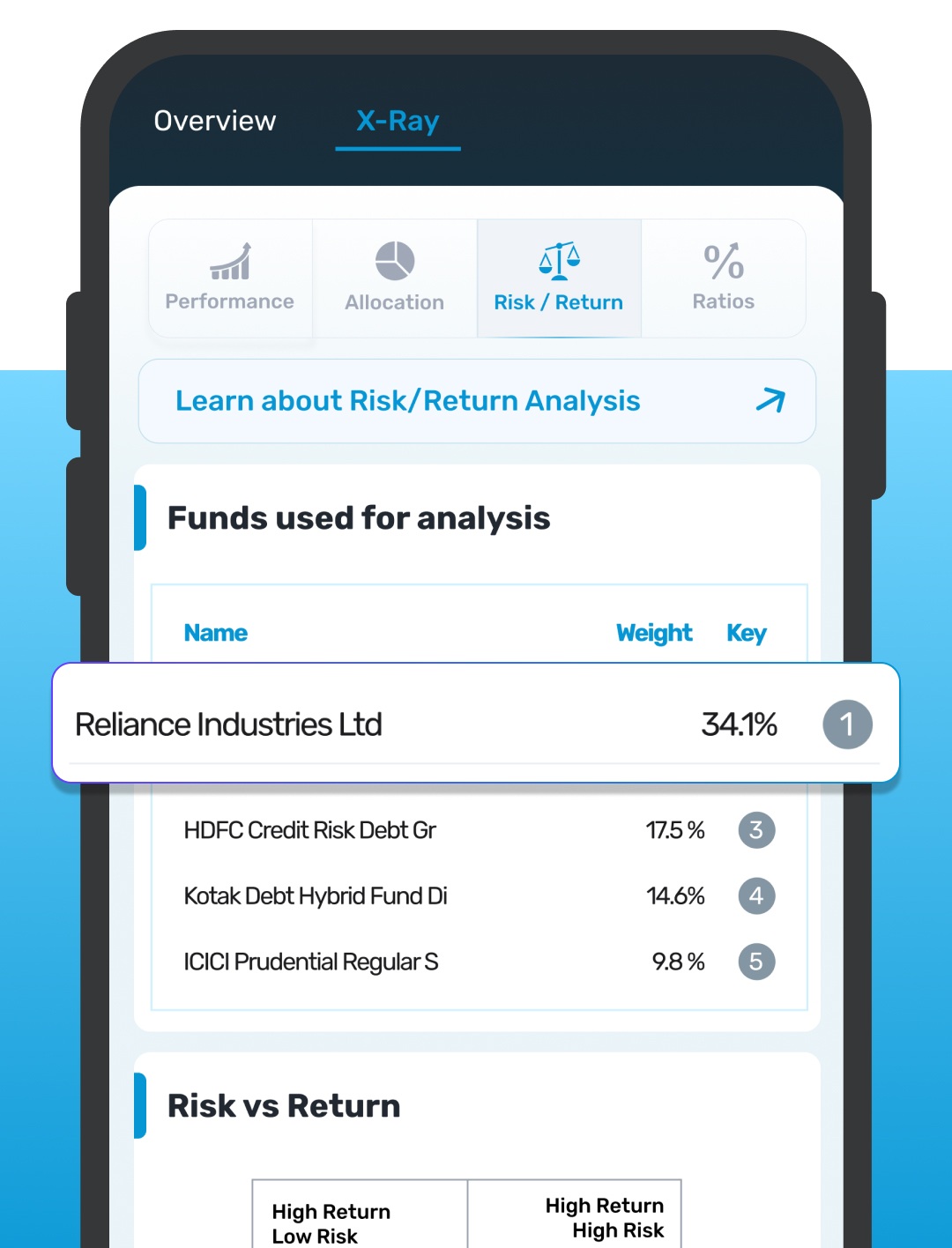

Holdings-Level Analysis

Get a clear view of your true exposure—down to the underlying securities.

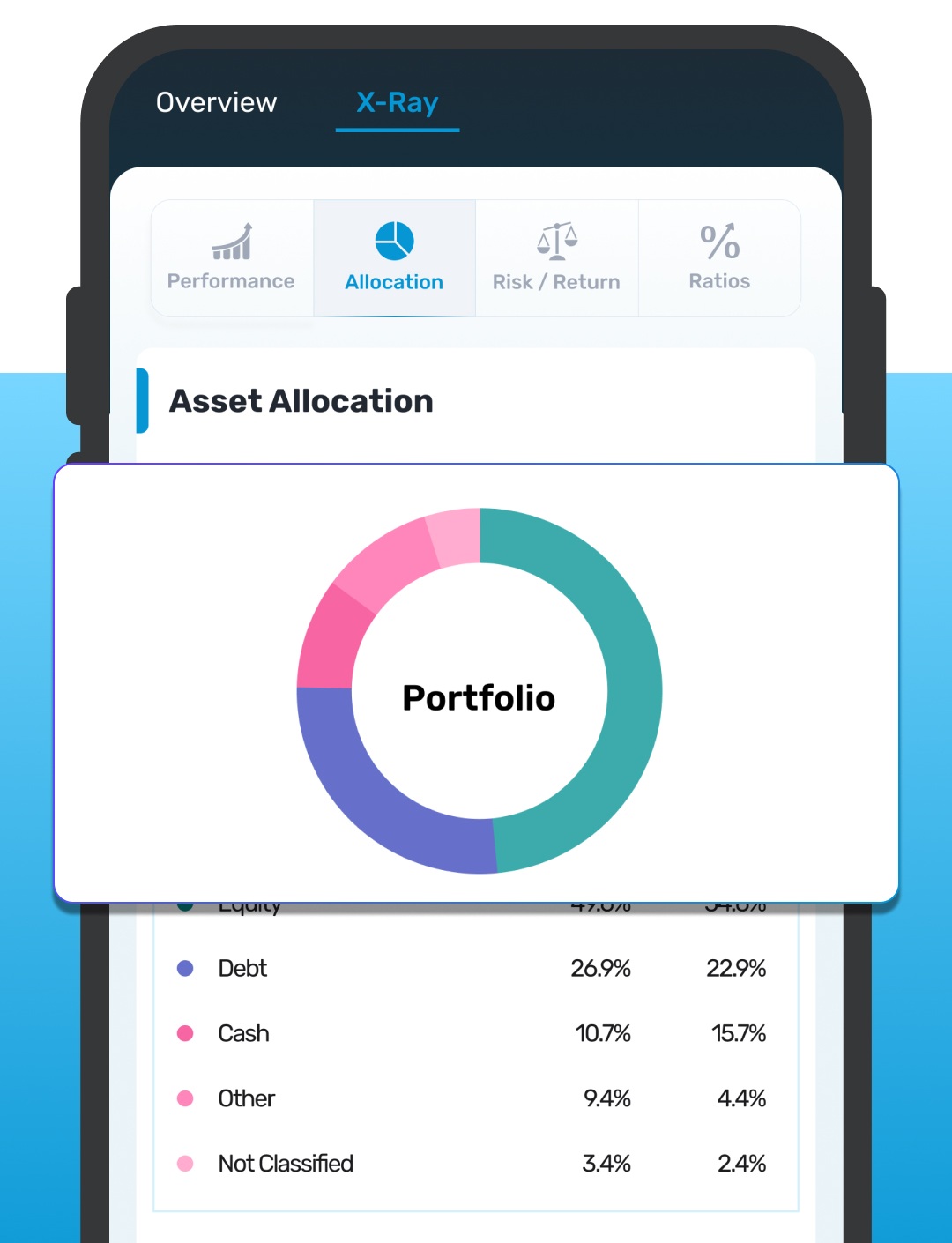

Portfolio Allocation Insights

Deep dive into your equity and debt holdings with detailed style boxes and performance ratios.

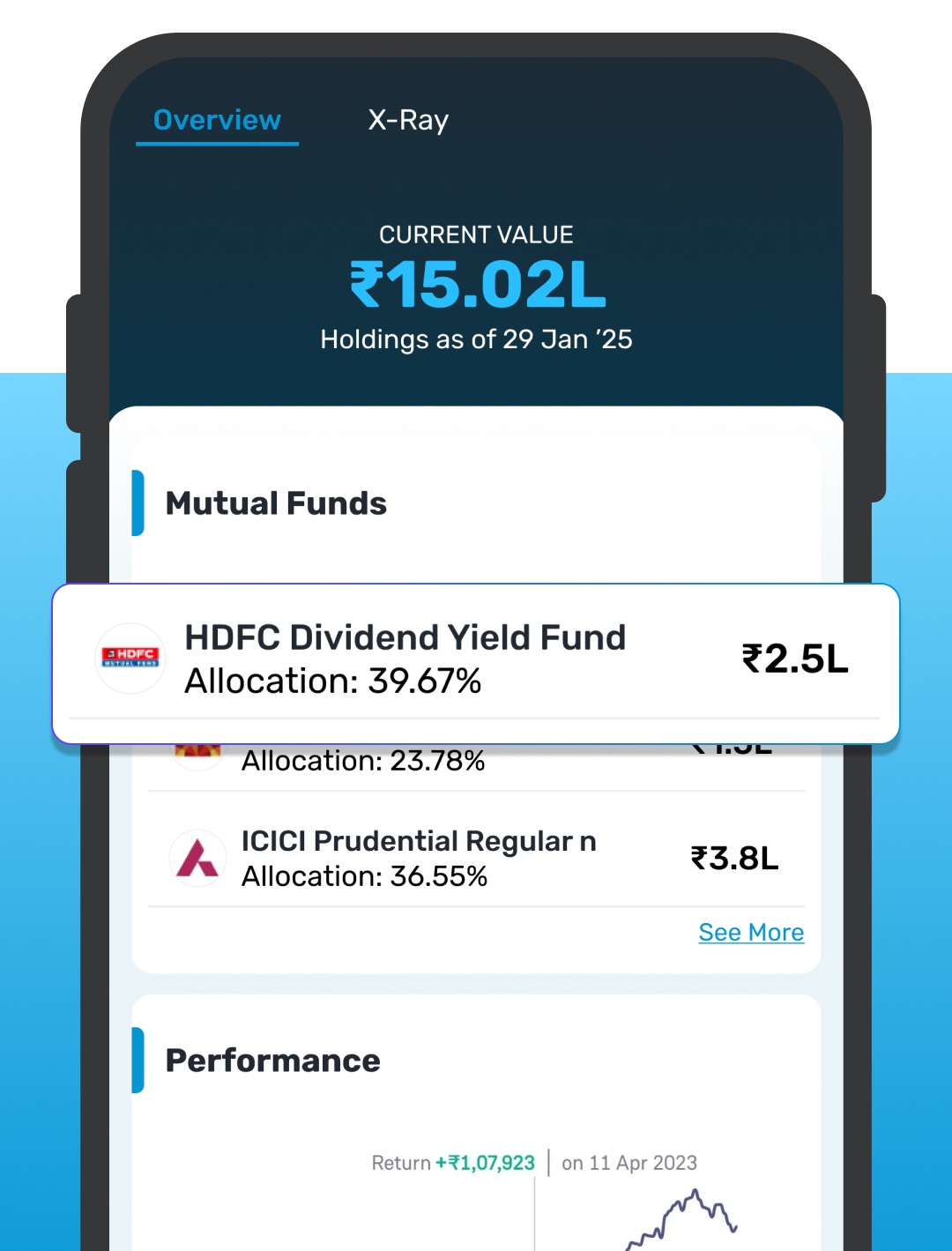

Comprehensive Portfolio View

Track your portfolio’s performance over time vs. benchmarks and get a clear view of how your holdings shape its long-term trajectory.

Get In Touch

Location

8th Floor, Block I, Vatika Business Park, Sohna Road, Sector 49, Gurugram, Haryana 122001

All rights reserved by Estee Advisors Private Limited

ESTEE ADVISORS PRIVATE LIMITED • SEBI Registration No: INA000016463 | CIN: U65990GJ2019FTC115697 5th Floor, Tower A, PO5-01A, PO5-01B, PO5-01C, Gift City Complex, Block 51, Zone-5, Road 5E, Gift City, Gandhinagar, Gandhinagar, Gujarat, 382355

Estee Advisors Private Ltd. is one of the leading names in the quant-based investment management and execution service provider.

Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.