A deep dive into Gulaq Gear 6 Portfolio performance

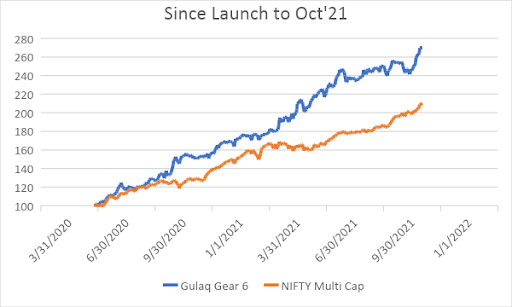

We had spent years in building and refining our quant models for Gulaq portfolios. The algorithms have produced promising backtested results. It was in 2020, we have received a green signal to go live.

Estee, the parent company of Gulaq and a pioneer in Quant trading in India since 2008, is managing one of the best performing PMS funds in India. Despite the strong track record, our team at Estee felt long only equity investing was a different ball game altogether.

We were confident that we have built premium Quant portfolios. But you never know what market throws at you. With confidence and the objective of making investing easier, we launched our first Gulaq Portfolio – Gear 6 in May 2020.

There were a few investors who invested with us in the 1st month. With the kind of performance Gulaq gave, our investors have grown significantly.

This month, in less than 2.5 yrs, we have given 200% returns in this portfolio. The benchmark has given about 100%.

Let’s do a deep dive into this portfolio’s performance since launch.

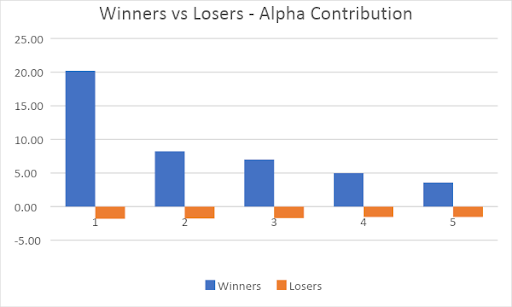

“It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong” – George Soros

Let’s see how Gear 6 portfolio has performed on these aspects. We have generated 49% alpha over the benchmark in FY 21-22. If you look at the Sharpe ratios, which measures risk adjusted returns, our Sharpe ratio stands at 2.91 versus 1.16 for Equity Multicap index.

One of the most important criteria for investing in a fund is how much money they make when they are right, vs how much money they lose when they are wrong.

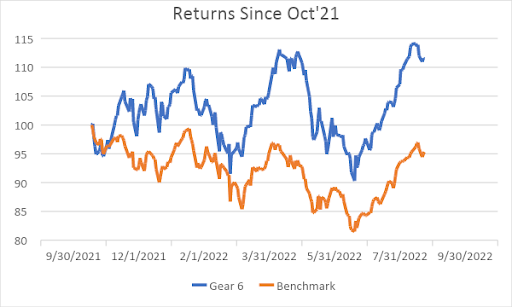

Since Oct’21 when markets made all time high, markets are still down by about 5%. But we have generated +11% returns.

Our top 5 winners generated on an average 8.8% alpha, whereas an average loser lost just about 1.7%.

Let’s look at the best and worst performers

| Key Winners | ||

|---|---|---|

| Stock Name | Avg Weight (%) | Contribution to Alpha |

| PERSISTENT SYSTEMS LTD | 14.91 | 20.20 |

| KPIT TECHNOLOGIES LTD | 4.95 | 8.21 |

| INDIAN ENERGY EXCHANGE LTD | 8.37 | 7.00 |

| L&T TECHNOLOGY SERVICES LTD | 1.69 | 4.97 |

| POLYCAB INDIA LTD | 5.89 | 3.58 |

| Key Losers | ||

|---|---|---|

| Stock Name | Avg Weight (%) | Contribution to Alpha |

| OIL INDIA LTD | 2.03 | -1.80 |

| TCI EXPRESS LTD | 2.75 | -1.78 |

| ELGI EQUIPMENTS LTD | 0.44 | -1.71 |

| CUMMINS INDIA LTD | 1.1 | -1.56 |

| GUJARAT GAS LTD | 4.10 | -1.54 |

3. Diversification:

We achieve diversification at factor level through our multi-factor investing approach. We track 130+ factors comprising of fundamental, technical, and macro-economic factors, and we rebalance our portfolios based on the changing market conditions.

Let’s take example of factors like value, growth, momentum, and low volatility. Value factor performs poor in bear markets. On the other hand, low volatility factor performs well in bear markets. Momentum performs well in up trending markets and poorly in downtrend. Hence, achieving factor level diversification makes portfolio robust and flexible for dynamic market conditions.

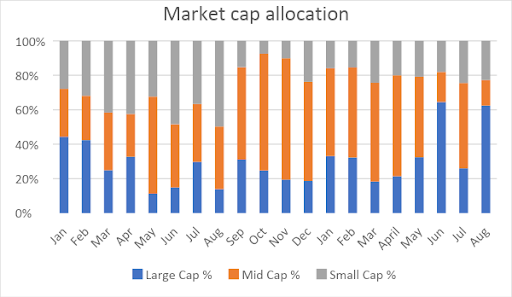

Let’s see how we have diversified the portfolio across market caps. Large and Mid-caps have captured lion-share of the allocation with 80% approximately. As we all know Gear 6 is 100% equity and suitable for aggressive investors. The 20% allocation towards the Small-caps is pretty much in line with the targeted risk category.

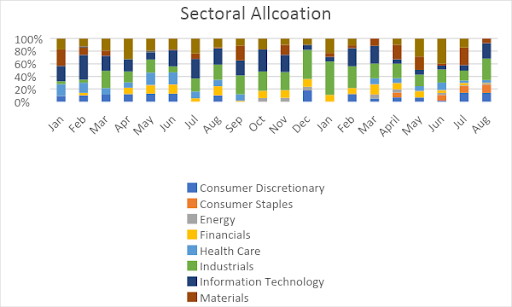

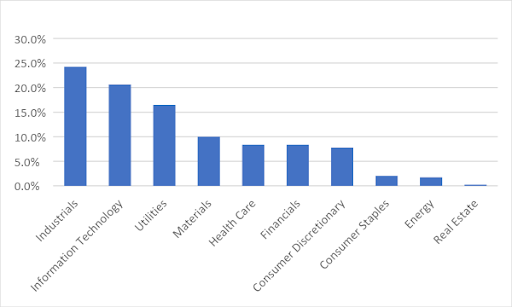

Last two years have witnessed speculations around recession, inflation, etc. During these volatile markets, it is evident that the allocation across sectors also has varied significantly in different time periods.

We are proud to see the brilliant performance of Gulaq Gear 6 portfolio on all the three fronts: Risk and Returns, Performance at stock level, and Diversification. We had spent years in researching, developing, and refining our algorithms. it’s a treat to watch them performing none to second.

In case you haven’t subscribed to Gulaq portfolios, do subscribe. Happy investing!

Related Posts

Smart Beta Strategies: What Investors Should Know Before Investing

Smart Beta Strategies: What Investors Should Know Before Investing As of August 2025, Indian mutual…

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…