SEBI Mandates Disclosure of Information Ratio for Mutual Funds

The Securities and Exchange Board of India (SEBI), in its latest circular, has mandated that all Asset Management Companies (AMCs) disclose a risk-adjusted return measure called the Information Ratio (IR) from April. This article explores how the ratio is calculated, its usefulness in analyzing mutual fund performance, and the challenges associated with its use.

Why Introduce a Risk-Adjusted Return Measure?

Investors often prioritize returns when evaluating mutual fund schemes. However, returns are only one side of the coin—risk is equally important. SEBI felt the need for a mandated disclosure of a risk-adjusted return measure to provide investors with a more comprehensive view of a scheme’s performance and a uniform way for AMC’s to disclose this information.

What is Information Ratio?

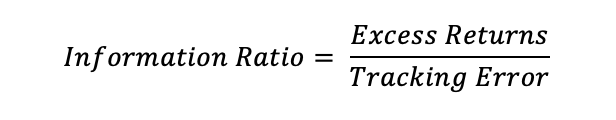

The Information Ratio is a relative measure of risk-adjusted returns, calculated using the following formula:

Where:

- Excess Return = Portfolio Rate of Return – Benchmark Rate of Return

- Tracking Error = Standard Deviation of Excess Returns

A higher Information Ratio reflects a fund manager’s superior ability to consistently outperform the benchmark.

Usefulness of the Information Ratio

a. Separating Wheat from Chaff

It is no secret that most actively managed funds fail to outperform their benchmarks. According to the SPIVA report, 77% of funds across all Indian active fund categories underperformed their benchmarks in the first half of 2024.

The Information Ratio is negative for funds that underperform their benchmarks, making it easier to separate outperformers from underperformers. This would help investors in narrowing down their list for further analysis.

b. Holistic Comparison of Fund Performance

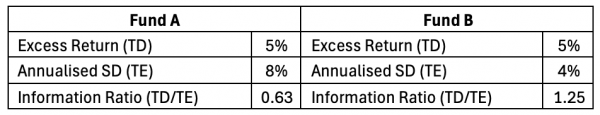

The Information Ratio enables a more comprehensive performance comparison. Consider two funds, A and B, within the same category:

The excess return earned by both funds is 5%. However, the annualized volatility of excess returns earned by Fund A is 8%, which is higher than Fund B’s 4%. As a result, Fund B has almost doubled the Information Ratio (1.25) compared to Fund A (0.63). This indicates that Fund B does a much better job at consistently outperforming the benchmark than Fund A. Investors who compare funds solely based on returns might have overlooked such critical insight.

Challenges of Using the Information Ratio

While the Information Ratio is a valuable metric, it has its limitations. It is a relative risk measure—the word “relative” is important here because it calculates risk as the standard deviation of excess returns. If the benchmark is more volatile in absolute terms than the fund, the denominator can inadvertently inflate, thus lowering the Information Ratio even if the fund has lower risk.

Disclosure Mandate

Starting April 2025, all equity mutual funds will be required to display the Information Ratio on their websites daily, covering 1-year, 3-year, 5-year, and 10-year periods. To facilitate better understanding among investors, AMFI will run education campaigns, while AMCs will use their education budgets to explain the concept through social media and other channels.

In Summary

SEBI’s mandate for the disclosure of the Information Ratio is a positive step for the mutual fund industry. It allows investors to evaluate performance more comprehensively and make informed decisions. However, while the Information Ratio is a useful tool, it should not be the sole criterion for fund selection. Investors must conduct deeper research before making investment decisions.

Related Posts

Smart Beta Strategies: What Investors Should Know Before Investing

Smart Beta Strategies: What Investors Should Know Before Investing As of August 2025, Indian mutual…

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…