How Has Gulaq Gear 6 Performed?

FY25 is now officially in the rearview mirror, and with that, our flagship portfolio — Gulaq Gear 6 — has built almost five years of a live track record.

The markets are navigating through turbulent waters right now, with sharp falls followed by swift recoveries. Amidst this chaos, it becomes even more important to zoom out and take a more objective, holistic look at the performance of Gear 6 over these past five years.

Performance

Gulaq Gear 6 was launched in May 2020, right after the COVID-19 fallout. As of March 2025, it has completed 59 months of live performance — nearly five years.

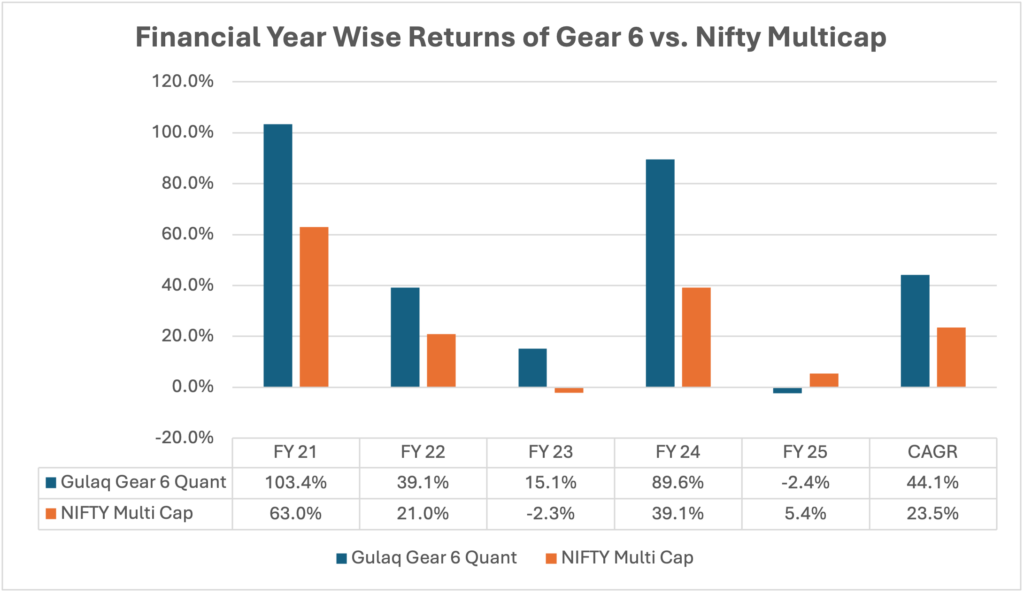

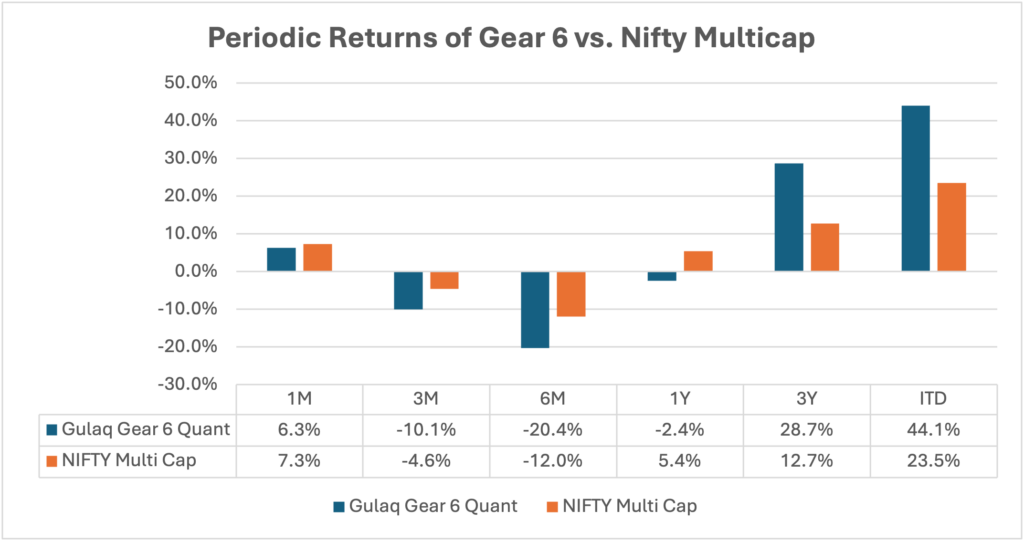

The data below shows the financial year-wise performance of Gear 6 against the Nifty Multicap Index, which serves as the benchmark.

Gear 6 has delivered a CAGR of 44.1%, massively outperforming the Nifty Multicap Index’s 23.5% over the same period. Year after year, Gear 6 has outperformed the benchmark — only underperforming in FY25.

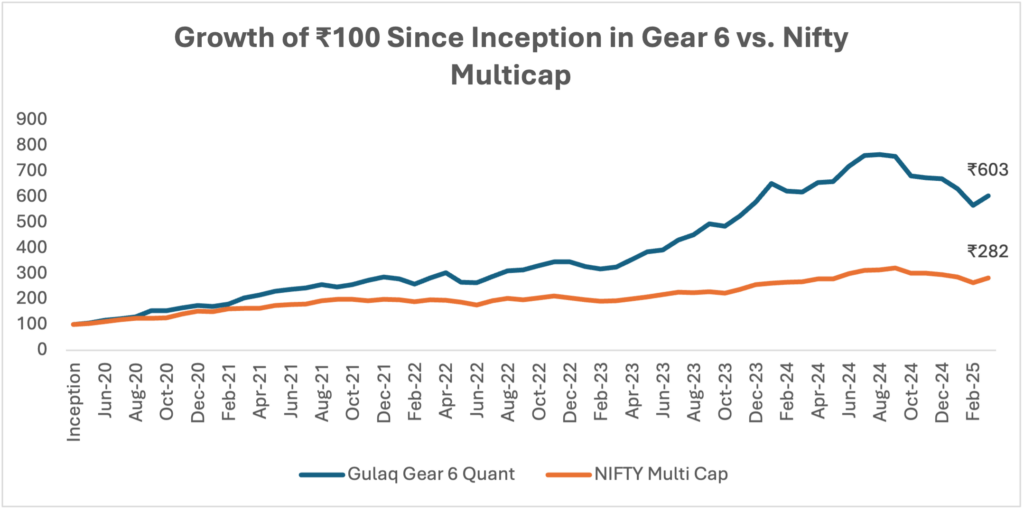

If we observe the rupee growth since inception — i.e., the growth of ₹100 invested in Gear 6 vs. Nifty Multicap — ₹100 would have grown to ₹603 by the end of FY25, compared to just ₹282 in the Nifty Multicap Index.

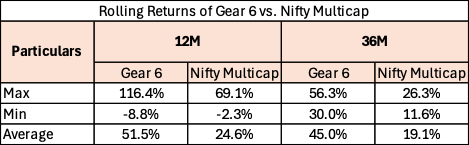

The outperformance of Gear 6 becomes even more evident when we look at rolling returns.

Over rolling 12-month periods, Gear 6 has delivered an average return of 51.5%, significantly ahead of the 24.6% average return from the Nifty Multicap. In fact, 92% of the time, Gear 6 outperformed the index over these 1-year windows.

When we extend the lens to rolling 36-month periods, the strength of this performance only grows. Gear 6 posted an average annualized return of 45.0%, compared to just 19.1% for the Nifty Multicap — with 100% of the 3-year rolling periods showing Gear 6 ahead.

However, if we shift our focus to more recent performance, it’s evident that Gear 6 has underperformed the benchmark in the short term. However, as we extend the investment horizon, Gear 6’s outperformance begins to surface.

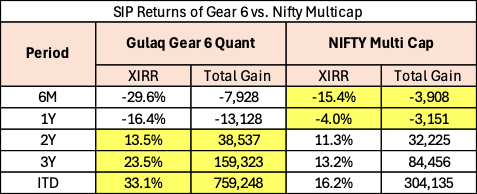

However, this return data is rarely a true reflection of what most investors actually realize. The above returns are Annualized Holding Period Returns, which assume a one-time investment at the beginning of the period, with no subsequent investments. In reality, investors don’t invest like that.

Most people invest periodically — perhaps with a portion of their monthly salary — building wealth through systematic investing. This helps in averaging the investment cost and riding out market volatility more smoothly, while also nurturing a habit of disciplined saving.

Hence, it’s crucial to look at the SIP performance of the portfolio across different timeframes.

Note: The SIP analysis assumes an initial lump sum of ₹24,000, followed by monthly SIPs of ₹10,000 at the beginning of each month.

Interestingly, the 1Y XIRR of both Gear 6 and Nifty Multicap is lower than their respective 1Y holding period returns. Why? Because of sequencing risk — the risk introduced by the order in which returns occur.

Q1 and Q2 were strong performers, while Q3 and Q4 were weaker. Due to monthly SIPs, gains were earned on a smaller capital base and losses on a larger one, dragging the XIRR down.

Hypothetically, if we reversed the order — Q4 and Q3 returns first, followed by Q2 and Q1 — the XIRR would’ve been +15%, with a total gain of ₹11,500.

Over time, however, this sequencing risk diminishes. As seen in the table, Gear 6 has outperformed Nifty Multicap as the investment horizon increases.

Risk

Returns are only one side of the coin. The other — equally important — is risk. And the two must always be considered together.

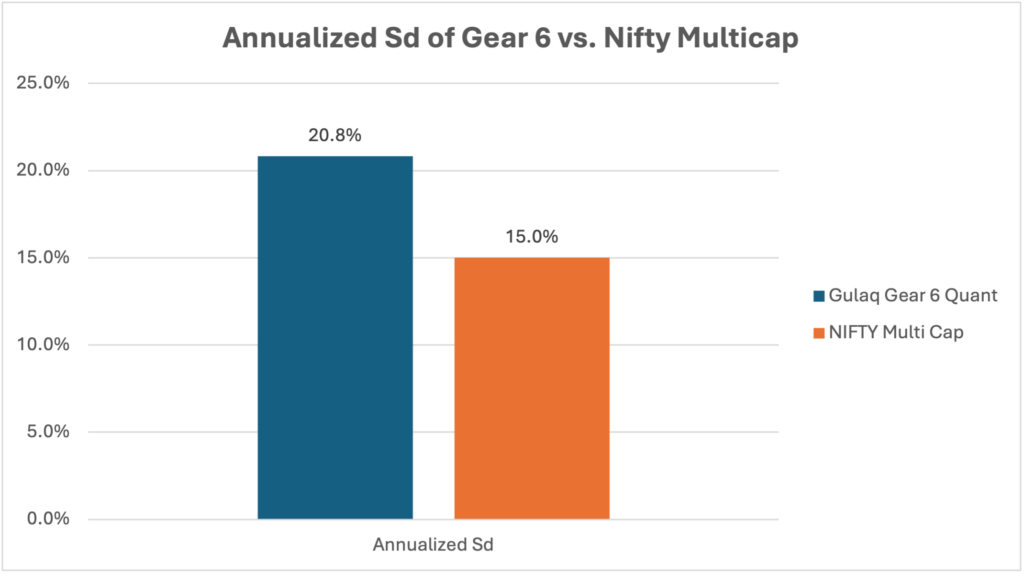

In traditional finance, risk refers to the deviation of actual returns from expected returns. Say, you expect to earn a 15% return, however, you might realize a -10%. That uncertainty is measured by standard deviation — the higher it is, the greater the risk.

Being a concentrated 15-stock portfolio, Gear 6 is naturally more volatile than the Nifty Multicap, which has exposure to the top 500 stocks.

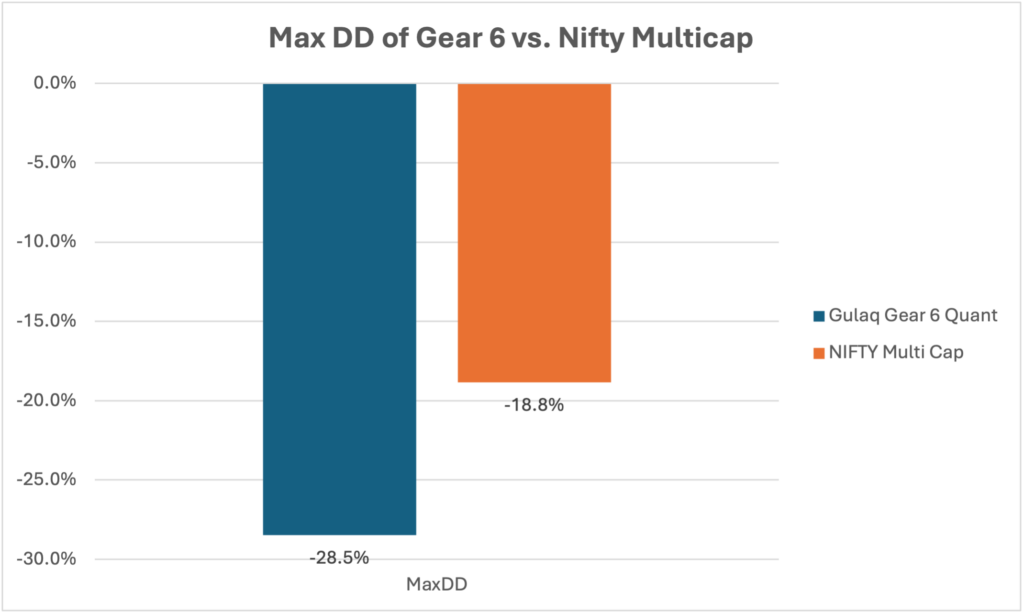

Extending the analysis to maximum drawdown shows a similar picture. Max DD measures how much historically the portfolio has fallen from the peak to its bottom.

Gear 6 has experienced deeper drawdowns — another sign of higher risk.

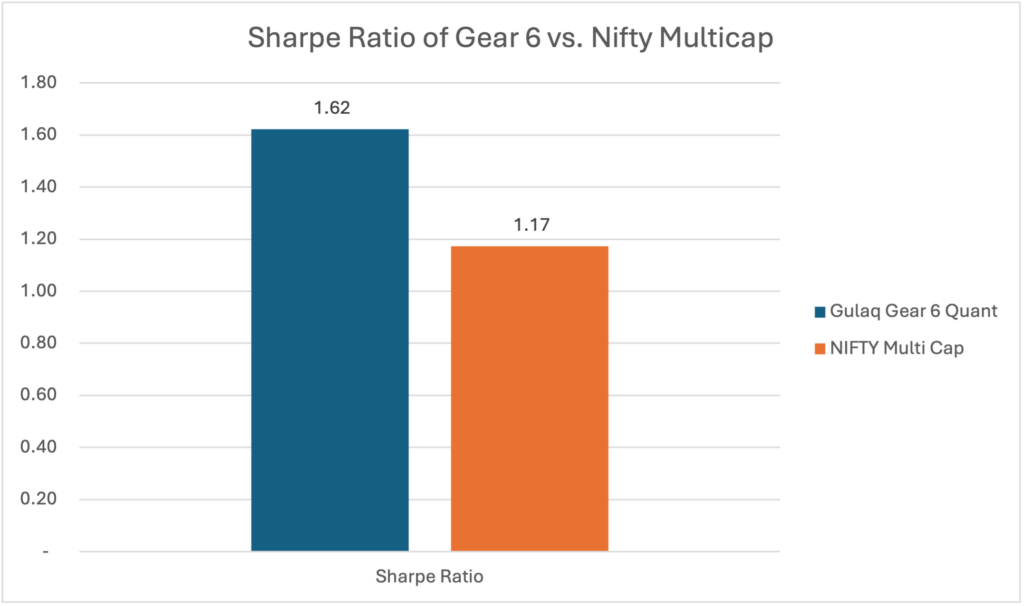

We’ve seen Gear 6 offers better long-term returns but also comes with higher risk. So, how do we compare the two meaningfully? Through risk-adjusted metrics like the Sharpe Ratio and the Information Ratio.

The Sharpe Ratio, which measures excess return per unit of risk, is significantly higher for Gear 6. This suggests that although Gear 6 takes on more risk, it rewards investors more for it than the benchmark does

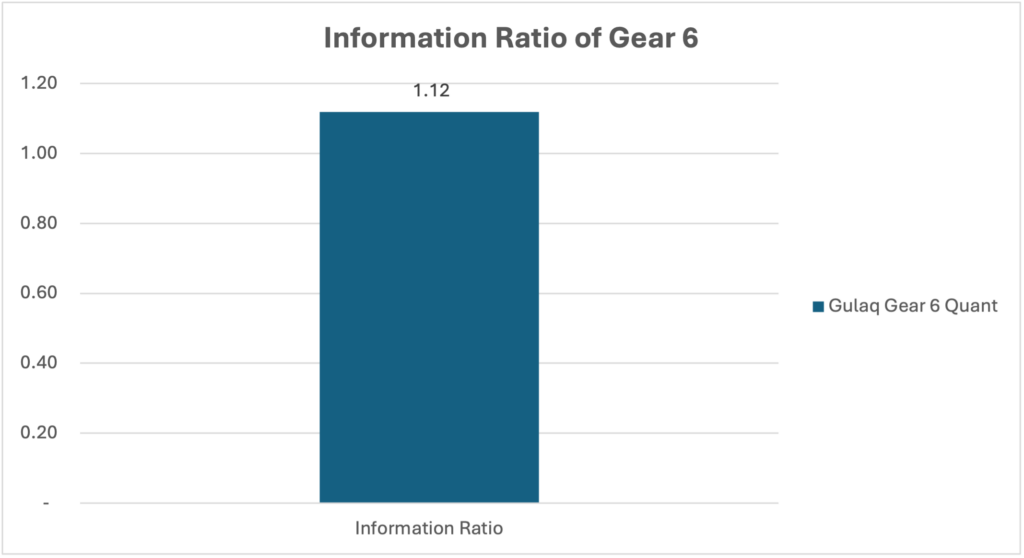

The Information Ratio reflects how consistently the portfolio beats the benchmark. A value above 0.5 is considered good. Gear 6 has more than double that, indicating consistency in outperformance.

Bottom Line

Gear 6 is currently navigating tough waters. Recent performance hasn’t matched up to the benchmark, and we’ve seen sharp monthly declines.

But this isn’t a new scenario. No strategy — however well-designed — can outperform at all times. The goal is not to beat the benchmark every single month, but to beat it often enough that over time, the average outcome is superior. Gear 6’s long-term record stands as a testament to the power of systematic and data-driven investing.

Unfortunately, myopia runs wild in the investment community. The recency bias can often cloud investors’ judgment and overwhelmingly influence investment decisions.

We’ve seen a lot of investors part ways with us recently, chasing funds that are performing well right now. But performance chasing is a dangerous strategy, and rarely leads to good financial outcomes. I have written about this previously.

My advise to investors is always the same, no matter market cycle—stay the course, ignore the noise, and continue your SIPs with discipline. That’s the best way to build long-term wealth.

Thank you for reading!

Related Posts

Smart Beta Strategies: What Investors Should Know Before Investing

Smart Beta Strategies: What Investors Should Know Before Investing As of August 2025, Indian mutual…

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…