Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted wherein we exclude promoter or government ownership. It is the most popular index in India and over the last 5 years it has delivered close to 22% returns.

Nifty 50 equally weighted index is another form of index which distributes weight evenly across the universe and over the last 5 years it has delivered 27% returns.

Nifty 500, which is a pure market cap weighted index, has delivered 25% over the last 5 years compared to Nifty 500 equally weighted which has delivered close to 34% returns over the same period.

Several smart beta indices like Nifty Momentum, Low Volatility, Value have also risen in popularity due to their significant outperformance against traditional market cap weighted indices.

This raises a question – is market cap the best way to build an index? What is the source of the outperformance of these alternate indices?

In this blog, I dive deeper into alternate methods of index construction and compare their characteristics to market cap weighted indices to find out which is the best way to build an index.

Building the Market Cap Weighted Index

Market cap is one of the earliest and most popular methods of building an index. Almost all the major indices around the globe follow a market cap weighted structure.

As per the Capital Asset Pricing Model, the market cap weighted global portfolio is theoretically the most optimal portfolio and, on a risk-adjusted basis, no other portfolio should be able to outperform it.

However, as we know, the real world is not perfectly efficient as assumed in theory, and over the years several academicians and practitioners have attempted to come up with alternate forms of indices that promise to have structural advantage over the traditional cap weighted index.

Building Alternate Indices

All the alternate indices can be loosely categorized into three types:

Heuristic based that uses some simple straightforward rule of thumb to construct the index like equal weighting or inverse volatility.

Optimization based indexes that are constructed using some mathematical function, like maximization of Sharpe ratio or minimization of variance.

Lastly, there are some fundamental based indexes that use some accounting measure like sales or cash flows to construct the index.

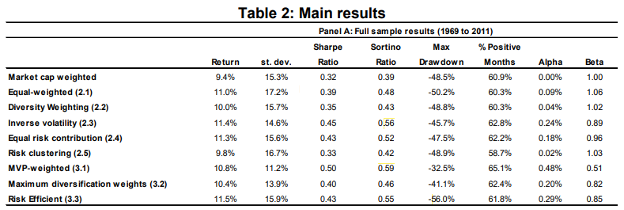

Research conducted by Andrew Clare, Nick Motson, and Steve Thomas from Cass Business School, City University London found that all the other alternate forms of indices were able to outperform the standard market cap weighted index.

Another study titled “A Survey of Alternative Equity Index Strategies” found similar results, reinforcing the outperformance of alternative strategies over traditional market-cap weighted indices.

While all of the alternate indices showed better returns than cap weighted, several of them also had higher standard deviations. But in terms of Sharpe Ratio which measures excess returns per unit of standard deviation, all the alternate indices performed better than standard cap weighted.

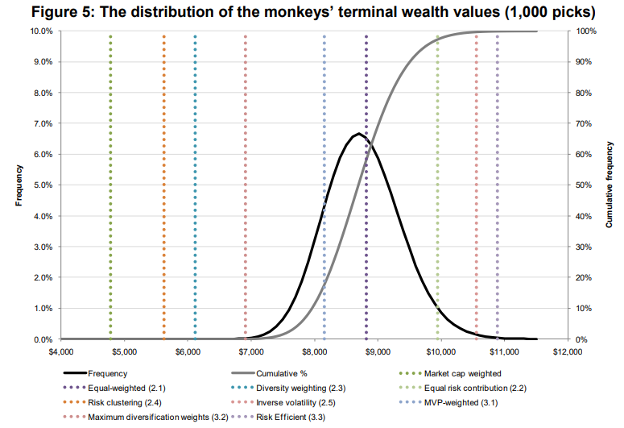

On finding this, the researchers at City University London did something drastic. They wanted to check if a randomly weighted indices would beat the market cap weighted one. So they decided to run a Monte Carlo simulation and create millions of random indices and compare their performance against the market cap weighted index. They called it the Monkey Test.

They found that the market cap weighted index performed worse than almost all the randomly generated indices in terms of the terminal wealth value.

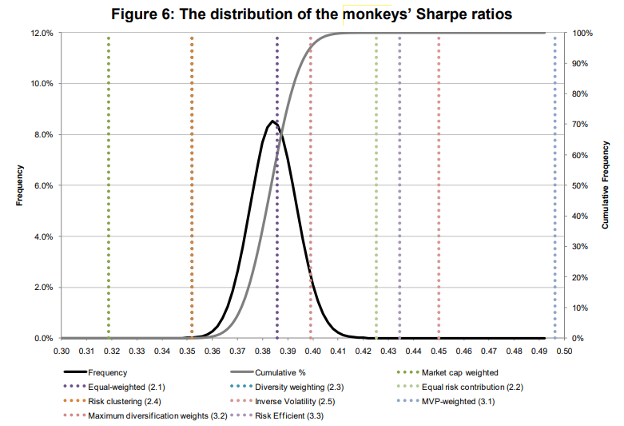

Even in terms of Sharpe ratio, the cap weighted index performed the worst compared to almost all the randomly generated indices.

This raised a very important question – why does the market cap weighted index perform worse than even randomly generated indices? Is there something structurally flawed in market cap weighting?

Source of Outperformance

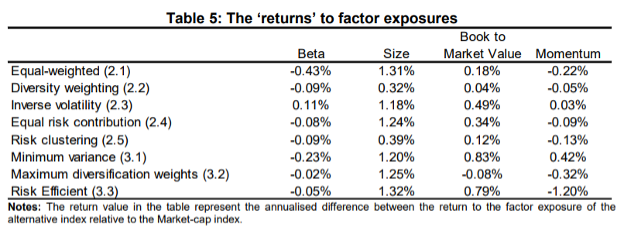

While the research shows that almost all other forms of indices outperform the market cap weighted, they do so not because of some structural advantage but because of inherent tilt towards value and size factors. They found that these alternate indices displayed statistically significant exposure towards size and value.

When the researchers used the Carhart 4-factor model that includes risk factors like market, size, value and momentum, to explain the variance in returns, the alpha remaining was not statistically different from zero.

Market cap weighted indices are inherently concentrated around large companies that have very low book-to-market value. Thus, when you move away from cap weighted index, you inherently gain more exposure towards smaller companies with higher book-to-market value.

For example, while the Nifty 500 has almost 70% of its weight towards large cap stocks and only about 10 to 15% towards small caps, Nifty equally weighted index allocates the weight evenly and thus has 50% exposure towards small caps.

Thus, yes, it is true that alternate indices can deliver statistically better returns than cap weighted indices. However, they do not do so because of some structural advantage but due to their higher exposure towards value and size factors.

Why Should You Care About Factor Exposure?

A fair argument can be made – why should you care about factor exposures?

If an alternate index is delivering better returns – why should you care if they are coming from exposure to some additional risk factor?

Well, because there are no free lunches in the market. The general axiom of the market is that you get compensated for risk you take. The higher risk you are willing to take, the higher could be your potential returns.

The reason these alternate indices are producing better returns is because they are talking on higher risk.

The systematic risk factors are the underlying risks that you accept while investing in the market. They are the drivers of returns.

Therefore, identifying those risk factors is important to appropriately understand where the outperformance you are seeing is coming from – is it really alpha or is it a result of you taking more risk?

Thus, while it is true that alternate indices do deliver better performance, they do so because of their higher exposure towards value and size risk factors.

Smaller companies tend to display higher drawdowns and more volatility than larger companies especially during market stress.

Similarly, in periods where value as a risk factor is not performing well, performance of alternate indices can lag behind the standard market cap weighted index. In fact, from 2006 till 2019, the nifty market cap index outperformed the equal weighted index by a significant margin.

Bottom Line

The bottom line is that from surface level, it is easy to get lured by the higher returns that these alternate indices promise. However, it is important to understand the source of the outperformance before making investment decisions.

In this blog, I have shown that market-cap weighted indices tend to be heavily concentrated in large companies with low book-to-market ratio, and thus when you compare it to alternate indices that inherently have a tilt towards size and value, you can see statistically better performance of these alternate indices.

If you are an investor who is okay with taking on more exposure towards value and size, then some of these alternate indices can make sense for you. However, structurally they do not provide any advantage over the standard market cap weighted index.

Related Posts

Smart Beta Strategies: What Investors Should Know Before Investing

Smart Beta Strategies: What Investors Should Know Before Investing As of August 2025, Indian mutual…

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…