Time In The Market > Timing The Market

Imagine if taking a few days off your work cost you your entire salary. Sounds extreme, right? Who would want to work in a place like that? Yet, in the world of investing, where your money is working for you, this happens all the time – missing out on a few of the market’s best months can significantly impact your total returns.

But how much?

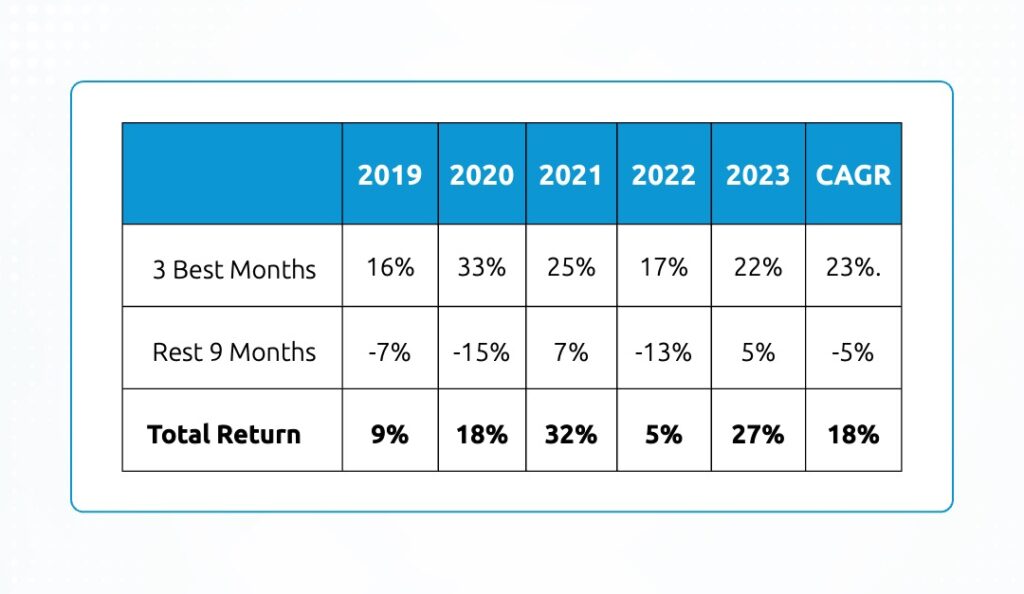

The table below shows the BSE 500 annual returns divided into returns attributable to the 3 best months (in terms of performance) and the rest of the 9 months. Here is what the data looks like:

See what I was talking about at the beginning of the blog post?

In the past 5 years, the BSE 500 has delivered a solid 23% compounded annual return, significantly better than the historical average. Miss the 3 best months in each year however, and now you’re making -5%.

How come?

Unlike our salaries, market returns are nonlinear. You simply cannot afford to sit out. You always have to be in the game because you can never predict with certainty when these best months might appear.

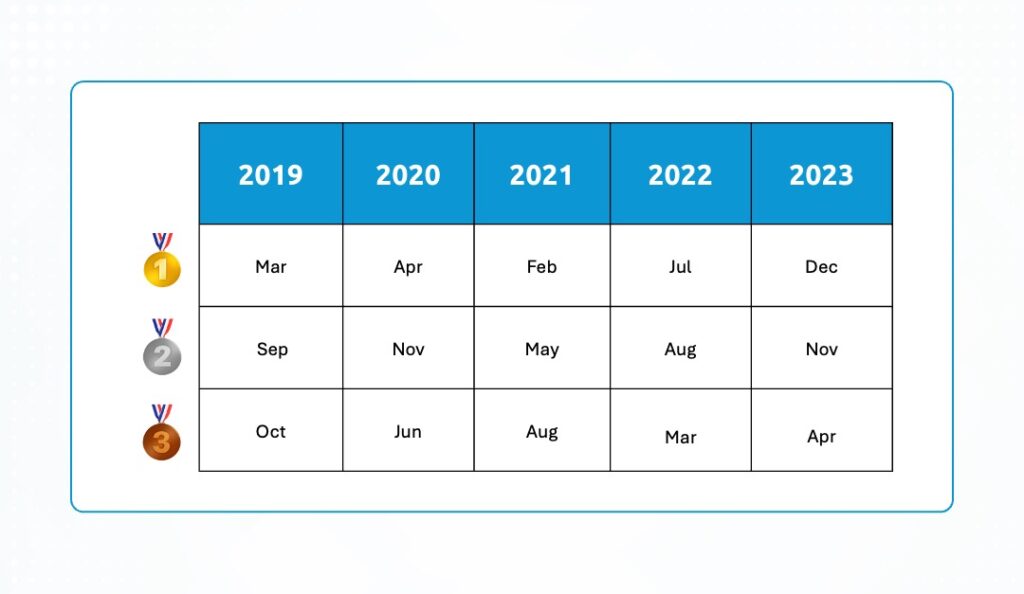

Below is the table of the top 3 months in each year. In the spirit of the ongoing Olympics, I have marked the best month in gold, the second-best in silver, and the third-best in bronze.

As you can see, there is no clear pattern here. The best 3 months are dynamic and very hard, if not impossible, to predict with confidence for anyone.

Market returns, unlike our salaries, are nonlinear. Considering the fact that losing out on these months means taking a serious hit to your annual returns, I say, it’s better to just stay invested.

As the age-old adage goes, “time in the market” beats “timing the market.”

Thank you for reading!

Related Posts

Smart Beta Strategies: What Investors Should Know Before Investing

Smart Beta Strategies: What Investors Should Know Before Investing As of August 2025, Indian mutual…

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…