Backtesting Gulaq Gear-6

Introduction

Backtesting is a fundamental tool used to evaluate the effectiveness of a trading strategy or investment approach by applying it to the historical market data. While it can provide valuable insights, it is essential to recognize that several biases can significantly impact the strength of your analysis.

Backtesting biases mostly fall under the category of cognitive bias and can be corrected or moderated by being more aware about them. In this article, we will cover the 5 most common backtesting biases that investors often succumb to and will provide practical advice on how to avoid them.

Let’s get started!

1. Survivorship Bias

Survivorship bias occurs when you only consider data from assets or investments that have survived until today and omitting those that failed or went bankrupt along the way. This can give you a false sense of optimism.

It is very commonly found in asset management industry. For instance, suppose you are analysing the historical performance of a group of hedge funds to determine which ones are the best investments. You gather the data on the returns of these funds over the decades. However, you see that some funds have underperformed or even gone out of business during that time.

If you only analyze the data of the funds that are still active today (i.e., the survivors), you are inadvertently excluding data from the funds that didn’t make it. As a result, your analysis would paint a rosier picture than what the reality is.

To avoid survivorship bias, you should include data from assets or investments that no longer exist in your analysis. This will provide a more realistic picture of how your strategy would have performed.

2. Overfitting

Overfitting happens when you tailor your trading strategy too precisely to past data, making it less likely to perform well in the future. You adjust your strategy based on every minor fluctuation in the historical data, creating a strategy that’s perfect for the past but fails to adapt to new market conditions.

To avoid overfitting, use a simple and robust strategy that is less likely to be influenced by noise in historical data. It’s essential to strike a balance between a strategy that fits historical data reasonably well and one that can adapt to changing market conditions.

3. Neglecting Transaction Costs

Many backtesting simulations forget to account for transaction costs such as commissions, slippage, and taxes. These costs can significantly impact the performance of a strategy. Ignoring them can lead to overly optimistic results.

For example, if your trading strategy involves frequent buying and selling, the cumulative effect of transaction costs can erode your profits. Make sure to include these costs in your backtesting calculations to get a more accurate estimate of your strategy’s potential performance.

4. Data Snooping Bias

“If you torture the data long enough, it will confess to anything” – Ronald Coase.

Data snooping bias occurs when you test multiple variations of your strategy on the same dataset and then select the one that performed the best. This cherry-picking approach can result in a strategy that looks great historically but fails in practice.

To avoid data snooping bias, you should split your historical data into two parts: one for strategy development and the other for testing. Develop your strategy on the first set and only use the second set for testing. This way, you’re less likely to inadvertently optimize your strategy based on historical data noise.

5. Neglecting Fundamental Factors

While technical analysis is crucial, neglecting fundamental factors can be a significant pitfall. For example, if your backtesting strategy focuses solely on technical indicators, it may miss critical market-moving events like earnings reports, economic data releases, or geopolitical events.

To avoid this pitfall, consider integrating fundamental analysis into your backtesting process. Combine technical and fundamental factors to get a more comprehensive view of your strategy’s potential performance.

Conclusion

In conclusion, backtesting is a powerful tool for assessing the viability of trading strategies and investment approaches, but it is not without its pitfalls. Recognizing and mitigating these biases is essential for obtaining realistic insights into how a strategy might perform in the real world.

Successful backtesting requires a holistic approach that takes into account the nuances and challenges posed by these biases. By doing so, investors and traders can make more informed decisions, better position themselves to navigate the dynamic markets, and increase their chances of achieving alpha.

Backtested results of Gulaq Gear-6

At Estee, we are always trying to make our models better by ongoing research.

We keep updating our models every 3-6 months. Below are the backtesting results of the current model we are using to construct Gear-6 portfolio.

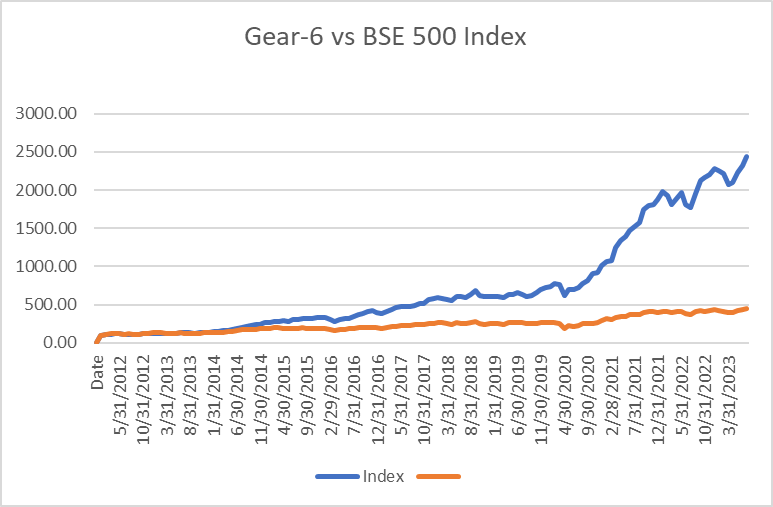

Rs 100 invested in BSE 500 would have become 451 and in Gulaq Gear-6 Rs 2400.

|

CAGR |

Volatility |

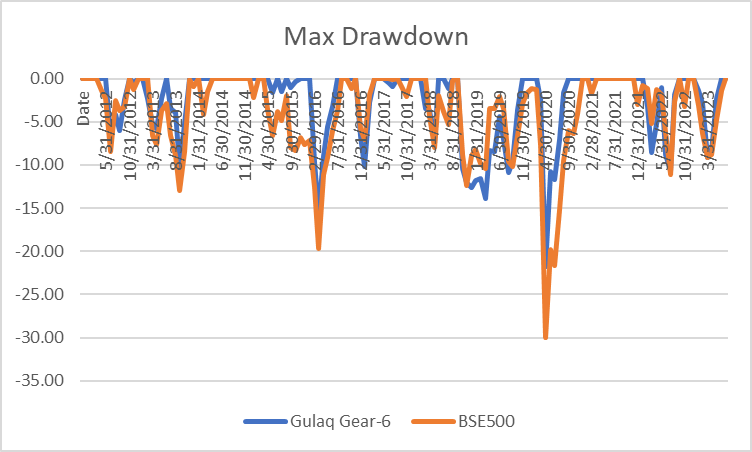

Max Drawdown |

Sharpe |

|||||

| 1 yr | 3 yr | 5 yr | 10 yr | overall | ||||

| Gulaq Gear-6 | 43.7% | 56.8% | 35.2% | 39.7% | 36.0% | 19% | -26.4% | 1.7 |

| BSE500 | 9.9% | 21.7% | 11.1% | 14.9% | 14.0% | 17% | -29.9% | 0.9 |

The overall volatility of Gear-6 portfolio is slightly higher, but sharpe ratio, which is an indicator of risk adjusted returns is also almost double.

This tells us that the extra risk we are taking is more than compensated by the extra returns the portfolio is able to generate.

Related Posts

Tax Harvesting: How to Reduce Your Tax Burden?

FY 23-24 has been great for Gulaq. We were able to generate phenomenal returns for…

Don’t Miss the Forest for The Trees: Why Maxing Out the Rs. 1.5 Lakh Limit on Your PPF Before 5th of April Is Not Worth the Hype

As the financial year has ended, the buzz around investing the entire Rs. 1.5 lakh…

Why Active Fund Investing is so hard?

Would you consider investing in a fund that has significantly trailed its benchmark over the…

Halo Effect can be Dangerous to your Portfolio!

Charlie Munger once famously said, “It is remarkable how much long-term advantage people like us…