My Prediction for 2024 (or 2044?)

A few years ago, a journalist reached out to me to get my views on the expected market returns for the next year. I wasn’t really sure what to say, so I gave him the most generic answer one could find – “I expect markets to give a 12-15% return next year.” Honestly, I had…

Read morePOSTED BY

Vivek Sharma

Goal Planning Done Right: The Appropriate Rate of Return to Plan the Future

Understanding Money and Goal Planning Money is an imaginary concept! In itself, it has no value. It’s just a piece of paper or a number on your computer screen. So why does everyone want it then? Well, you don’t want money just for the sake of having it. You want money because of what it…

Read morePOSTED BY

Vivek Sharma

5 Market Calls Made by Howard Marks

Introduction Howard Marks is a well-known name in the world of finance. He is the co-founder and chairman of Oaktree Capital Management and has made a fortune by investing in distressed companies. He has also authored the best-selling book, “Mastering the Market Cycle” and believes that superior investment result comes not from collecting more economic…

Read morePOSTED BY

Vivek Sharma

How Warren Buffet made his first Million Dollars

Introduction Arnold Schwarzenegger once jokingly said, “The first million is the hardest to make, so start with the second”. Well, he might have said that in a humorous way, but it is somewhat true, the first step is always the hardest. Warren Buffet is the most successful investor the world has ever seen. As of…

Read morePOSTED BY

Vivek Sharma

Herd Mentality Bias

Imagine you’re in a new city, hungry and trying to choose a place to eat. Two restaurants catch your eye—one bustling with a line of customers, and the other, nearly empty. Which one do you pick? Most people in this scenario would choose the busier restaurant. While some might be rationally concluding that more crowd…

Read morePOSTED BY

Vivek Sharma

How Long Does it Take to Double Your Money?

Building wealth through traditional means depends upon two factors – how much you save/ invest and the rate of return on investment. While the return on investment is something which is not always in our control, the savings rate is. And as we will show in this article, that the savings rate is a more…

Read morePOSTED BY

Vivek Sharma

Overconfidence Bias

Do you consider yourself to have an above-average intellect? If so, you’re not alone. Approximately 65% of the people who were asked this question considered themselves to possess superior intellect and have a brighter future than an average person. Another similar survey asked people whether they considered themselves to be an above average driver, and…

Read morePOSTED BY

Vivek Sharma

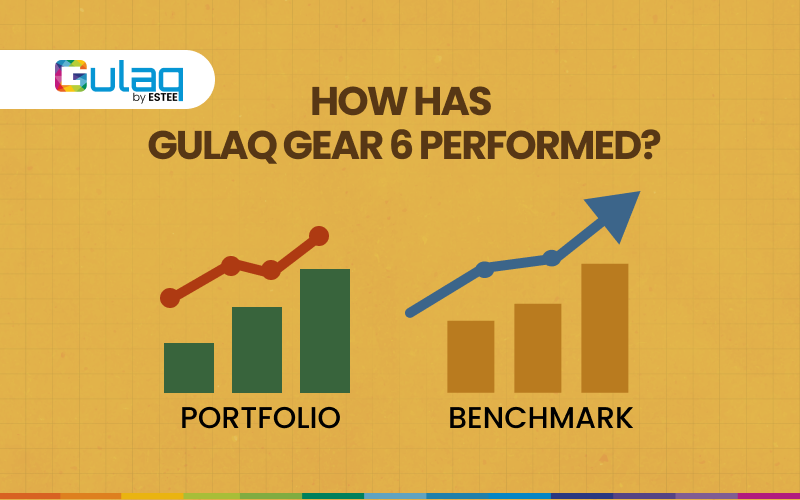

Backtesting Gulaq Gear-6

Introduction Backtesting is a fundamental tool used to evaluate the effectiveness of a trading strategy or investment approach by applying it to the historical market data. While it can provide valuable insights, it is essential to recognize that several biases can significantly impact the strength of your analysis. Backtesting biases mostly fall under the category…

Read morePOSTED BY

Vivek Sharma

Risks Associated with Investing in Gulaq Gear-6

Since we went live with Gulaq portfolios in May 2020, we have learnt quite a few things about this business. Not that managing money was new to us, we have been managing money for HNIs and institutions for over 13 years now. But managing money for retail investors is altogether a different ballgame. One of…

Read morePOSTED BY

Vivek Sharma

Market Linked Debentures

Introduction Market-linked Debentures (MLDs) have largely remained unpopular in India due to their high ticket sizes. However, things are changing now. Investment opportunities are being democratised and retail investors are having more and more opportunities to diversify their portfolios and potentially earn higher returns. In this article, we will be demystifying MLDs, explaining what they…

Read morePOSTED BY