3 Biggest Misunderstandings About Compound Interest

Compound interest is one of the most powerful forces on earth. It can do great things when used to create wealth. Understanding how compound interest works is an indispensable tool for living a wealthy life. This article will show you how to make sure that compound interest is always working in your favor.

Power Of Compounding: The Basics

The definition of compounding interest may seem obvious, but there’s more to this seemingly simple concept than it first appears. This effect of compound interest works both ways. Money left alone in a savings account for even just one year can be developed by compound interest. That is if the account earns at least a minimum amount of interest per year. In this sense, receiving an annual interest rate of 3% on your savings account may be more significant than it seems.

In fact, if you add around Rs 100000 to your savings account (and the money allows for continuous growth over time), then in just one year, you will have earned what looks like a small sum: only Rs 744.250. Yet, that small initial investment will double to become Rs 1488.500 after just two years. But after five years (Rs 3721.250), ten years (Rs 7442.500), fifteen years (Rs 29770.000), or even twenty-five years (Rs 119080.000). That’s the life-changing power of compounding! And all because you let compounding take its natural course, and you didn’t touch the original investment.

This concept of compounding interest over time is what makes it possible to turn a small sum into millions or a small amount of money into an enormous fortune. And this power really becomes apparent when we remember that compound interest actually works best in the long term. That’s because, as a general rule, more time allows for greater profits through compound interest: after ten years, Rs 744.250 will become Rs 2977.000 (a 200% increase), but twenty-five years later, it’ll be worth Rs 119080.000 (a 4000% jump).

Misunderstanding Regarding The Power of Compounding:

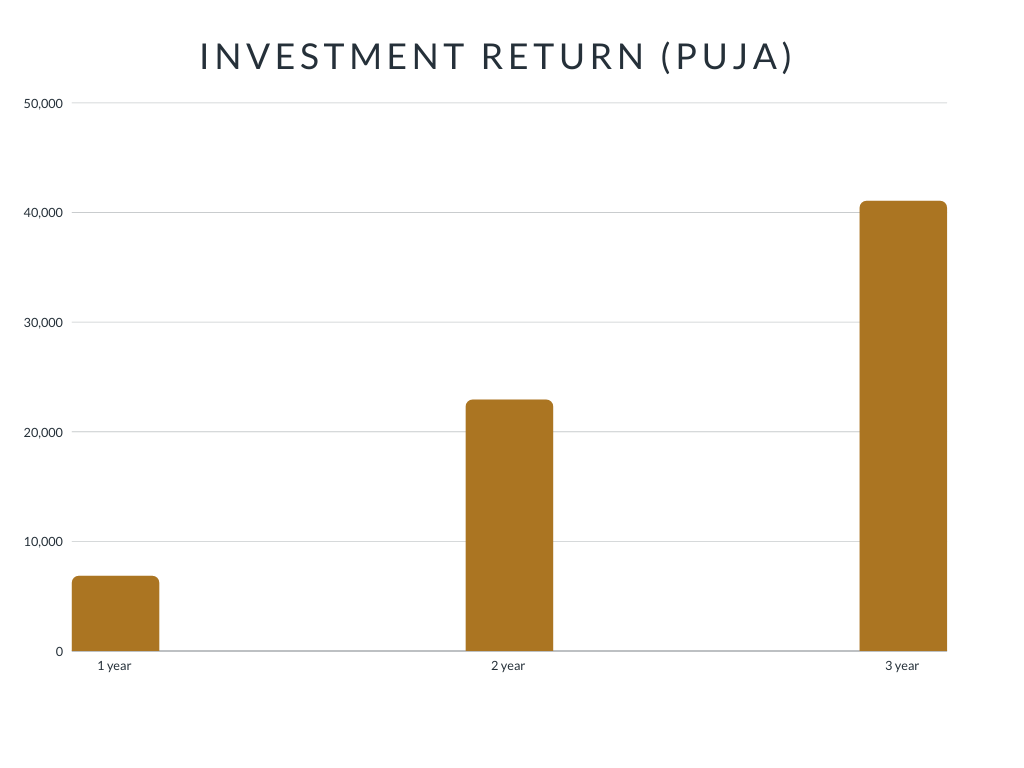

Puja invests INR 10,000 monthly into the stock market starting at age 22 and earns 12% average annual returns each year until age 45.

Kartik invests 15,000 every month and earns 12% average annual returns until age 45. But he doesn’t start investing until he is 30 years old, which makes his total investment amount less than Edgar’s when they both reach the same age.

| Year | Puja (Yearly Return) | Kartik (Yearly Return) |

| 22 | 1,20,000 | |

| 23 | 1,26,825 | |

| 24 | 2,69,735 | |

| 25 | 4,30,769 | |

| 26 | 6,12,226 | |

| 27 | 8,16,697 | |

| 28 | 10,47,099 | |

| 29 | 13,06,723 | |

| 30 | 15,99,273 | 1,80,000 |

| 31 | 19,28,926 | 1,90,238 |

| 32 | 23,00,387 | 4,04,602 |

| 33 | 27,18,959 | 6,46,153 |

| 34 | 31,90,616 | 9,18,339 |

| 35 | 37,22,091 | 12,25,045 |

| 36 | 43,20,970 | 15,70,649 |

| 37 | 49,95,802 | 19,60,084 |

| 38 | 57,56,220 | 23,98,909 |

| 39 | 66,13,078 | 28,93,389 |

| 40 | 75,78,606 | 34,50,580 |

| 41 | 86,66,588 | 40,78,438 |

| 42 | 98,92,554 | 55,83,136 |

| 43 | 1,12,74,002 | 64,81,455 |

| 44 | 1,28,30,653 | 74,93,703 |

| 45 | 1,45,84,726 | 86,34,330 |

At the age of 45 Puja ends up with about 1.5 crore whereas Kartik earns 86 lacs

- In Puja’s first year of investing, she earned a 12% return on his 1,20,000. That’s Rs 6,825.

- In his second year, she contributed 1,20,000 more and earned a 12% return on the new total, which was. She made an extra amount that amounted to about 22910.

- In her third year, she put in 1,20,000 again and made a 12% return on her total of 3,89,735. That is 41034.

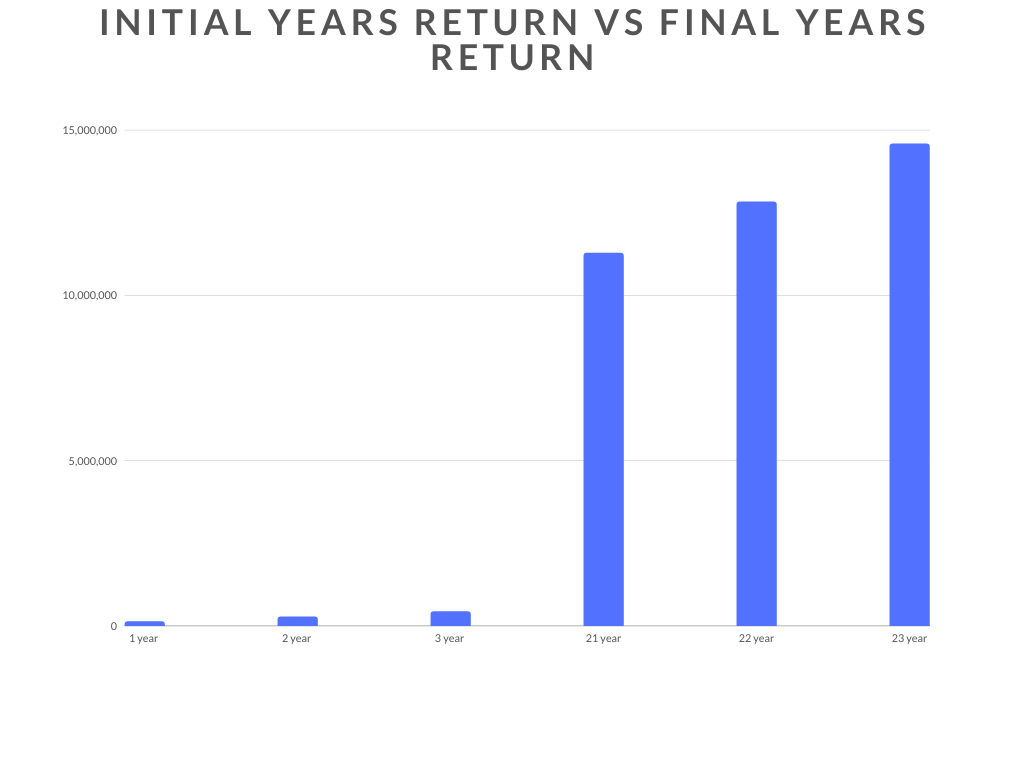

In the last three years leading up to age 65, Puja earned Rs12.6 lacs, Rs 14.4 lacs, and Rs 16.3 lacs, respectively, in the last three years, and if you can notice, her investment returns in those early years are peanuts compared with what she made later on.

In Short The 3 Misunderstandings Are:

- We think that the more amount we invest the better the result we get, but that’s not necessarily true. The longer we invest the better results we get.

- If we start early, we can earn from the power of compounding early, But that’s not true, the true potential of investment is actually seen in the end years.

- Some think that they can rely on your investment amount to earn in your 20s if you start early, but that’s not true, you should find other ways to earn in your 20s.

Related Posts

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…

All Nifty Bees Are Equal — But Some Are More Equal Than Others

The title, inspired by George Orwell’s classic Animal Farm, perfectly captures the essence of this…