Debt Funds Deep Dive

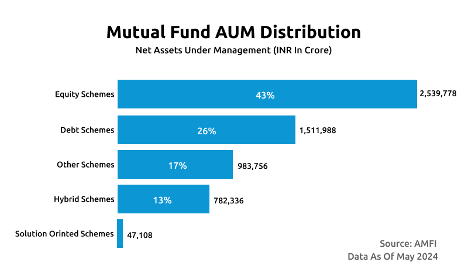

Debt Funds are funds that invest primarily in fixed income securities of government and corporates. As of May 2024, it has over Rs. 15 lakh crore in assets under management (AUM) – about 26% of the total AUM in the industry. In this blog, we are going to take a deep dive into debt mutual funds.

Types of Debt Mutual Funds

SEBI classifies debt funds into 16 difference schemes based on strategy and duration. This offers investors a plethora of options to select funds that meet their investment objectives.

On the basis of duration, debt funds are classified from overnight funds to long-duration funds.

- Overnight Fund

Overnight funds are a type of debt fund that invests in securities with a one-day maturity. They offer high liquidity and low risk, making them ideal for short-term parking of surplus cash ideally up to 1 week.

There has been a noticeable shift towards overnight funds. In the last 5 years, the AUM under the category has increased from 14k cr to 90k cr marking a year-on-year growth of 46%. It’s attribution to debt fund aum has increased from 1% in May 2019 to 6% now.

Investors are drawn to these funds for short-term cash management, especially during market volatility. The funds’ overnight maturity ensures stable returns and reduces interest rate risk. Additionally, they provide an alternative to traditional savings accounts with potentially better returns while maintaining safety and ease of access to the invested capital.

- Liquid Fund

Liquid mutual funds invest in short-term debt instruments like commercial papers, government securities, treasury bills, etc., with maturities up to 91 days.

These funds are often used for managing surplus cash and provide returns that are generally higher than those of savings accounts. They are also suitable for putting aside funds for emergencies as they offer high liquidity with no entry or exit load.

Liquid funds are the most popular category amongst debt funds, however, the category has seen some decline recently due to the appeal of overnight funds and other ultra-short duration funds, which offer similar liquidity with potentially better returns.

- Ultra Short Duration Fund

Ultra short duration mutual funds invest in debt securities with maturities between 3 to 6 months.

They are ideal for short-term investments, offering higher returns than liquid funds while maintaining low risk. These funds are suitable for those looking to park money for a few weeks to months with minimal risk of loss, provided the investment period is at least three months.

- Low Duration Fund

Low duration funds invest in debt securities of companies with maturities between 6 to 12 months.

The average returns of these funds range between 6.5% and 8.5% and are ideal for investors wanting to park their money for 6-12 months and earn returns better than a savings account.

- Short Duration Fund

Short duration funds invest in debt securities of companies with maturities between 1 to 3 years.

These funds take exposure in fixed income securities of quality companies with track record of timely payments. The returns can range anywhere from 6% to 10%. These funds can deliver better returns than traditional Fixed Deposits and are ideal for investors with investment horizons greater than 1 year.

- Medium Duration Fund

Medium duration funds invest in debt securities of quality companies with maturities of 3 years or more.

These funds have a higher duration than the funds we discussed above and hence are subject to interest rate risk. The average returns of these funds usually range between 7% and 9%, making them a worthy replacement for medium-to-long-term fixed deposits.

- Medium to Long Duration Fund

Medium to long duration funds invest in debt securities of companies with maturities between 4 to 7 years.

These funds carry higher risk compared to short duration funds due to their extended maturity period. The long duration makes them extremely vulnerable to interest rate changes caused by reversals in the economic or business cycle. The average returns of these funds are around 6.2%, offering a balance between risk and return for investors with a longer investment horizon.

- Long Duration Fund

Long duration funds invest in debt securities with maturities of more than 5 years.

These funds are more risky than other debt funds due to their longer duration and are suitable for investors with a high-risk appetite and a long-term investment horizon.

They are highly sensitive to interest rate changes which can significantly impact on their performance. The average returns of these funds can vary but tend to be attractive for those willing to endure higher volatility.

- Money Market Fund

Money market funds invest in debt securities with maturities of up to 1 year.

This is the second most popular type of debt fund (second to liquid funds) and has over Rs.190K crore in Assets Under Management (AUM) as of May 2024.

They primarily invest in high-quality short-term debt instruments like Treasury bills (T-bills), commercial papers, certificates of deposit (CDs), repurchase agreements (repos), and bankers’ acceptances. These securities are highly liquid, have short maturities (typically less than a year), and carry very low credit risk.

Money market funds offer lower risk than ultra short and low duration funds while providing better returns than fixed deposits (FDs) with similar durations. This makes them an attractive option for conservative investors seeking liquidity and better returns within a short-term investment horizon.

- Dynamic Bond Fund

Dynamic bond funds are debt funds that ‘dynamically’ manage the lending duration.

This flexibility allows fund managers to leverage interest rate movements in the economy to potentially enhance returns. They adjust the lending duration based on whether interest rates are anticipated to decrease or increase.

Over the last 5 years, this category has demonstrated a respectable year-on-year growth of 11%.

Dynamic bond funds are suitable for investors with at least a 3-5-year investment horizon. These funds can offer the potential of high returns, however, their performance hinges significantly on the fund manager’s ability to accurately predict interest rate trends.

- Corporate Bond Fund

Corporate bond funds invest at least 80% of their total assets in corporate bonds issued by companies with good credit ratings.

Businesses generally issue these securities to finance their short-term expenses, such as working capital needs, advertising, and insurance premium payments.

Over the last five years, corporate bonds have surged in popularity, becoming the 3rd most popular debt fund category in terms of assets under management (AUM) (following liquid and money market funds). As of May 2024, corporate bond funds manage about 150,000 crores in AUM, a significant increase from 64,000 crores in May 2019.

These funds tend to deliver better returns than bank fixed deposits of similar duration, making them an attractive option for investors with an investment horizon of 2-3 years.

- Credit Risk Fund

Credit risk funds allocate at least 65% of their total assets to debt securities of companies with lower credit ratings.

This makes them one of the riskiest categories of debt funds due to the higher probability of default. These funds are suitable for aggressive investors seeking higher returns, with an investment horizon of at least 3 to 5 years.

Over the last five years, credit risk funds have experienced significant decline. Their assets under management (AUM) have plummeted from 76,000 crores in May 2019 to just over 22,000 crores in May 2024, reflecting a -22% year-on-year decline. The primary reasons for this are higher default rates induced by the COVID-19 pandemic and poor liquidity.

- Banking and PSU Fund

Banking and PSU funds invest at least 80% of their total assets in debt securities of banks and public sector undertakings (PSUs).

Because the quality of borrowers in these funds is high, the probability of default is very low.

As of May 2024, these funds have an AUM of just over 80,000 crores and have experienced a decent growth rate of 15% over the last five years. They funds are ideal for conservative investors with a 2–3-year investment horizon.

- Gilt Fund

Gilt funds primarily invest in government securities.

These funds carry little to no risk of non-payment because the securities are backed by the full faith and credit of the government issuing them. They are ideal for conservative investors looking for stable returns over a longer investment horizon of at least 3 to 5 years.

- Gilt Fund with 10-year constant duration

A gilt fund with a 10-year constant duration invests passively in government securities with a 10-year duration, functioning much like an index fund for 10-year G-Sec.

These funds carry no risk of non-payment and typically offer better returns compared to medium-duration funds. They are well-suited for investors with a long-term investment horizon seeking stable returns.

Gilt funds have seen remarkable growth in the last 5 years but still contribute less than 3% to the total debt assets under management (AUM). The 10-year constant duration fund has grown 10 times in the last 5 years, with AUM increasing from 500 crores in May 2019 to over 5000 crores now.

- Floater Fund

Floater funds invest at least 65% of total assets in floating rate bonds, appealing to investors seeking income with reduced interest rate risk compared to fixed-rate debt instruments.

These funds have displayed a respectable year-on-year growth of 12% over the last 5 years and have assets under management (AUM) of over 50,000 crores.

Related Posts

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…

All Nifty Bees Are Equal — But Some Are More Equal Than Others

The title, inspired by George Orwell’s classic Animal Farm, perfectly captures the essence of this…