Equity Mutual Fund Deep Dive

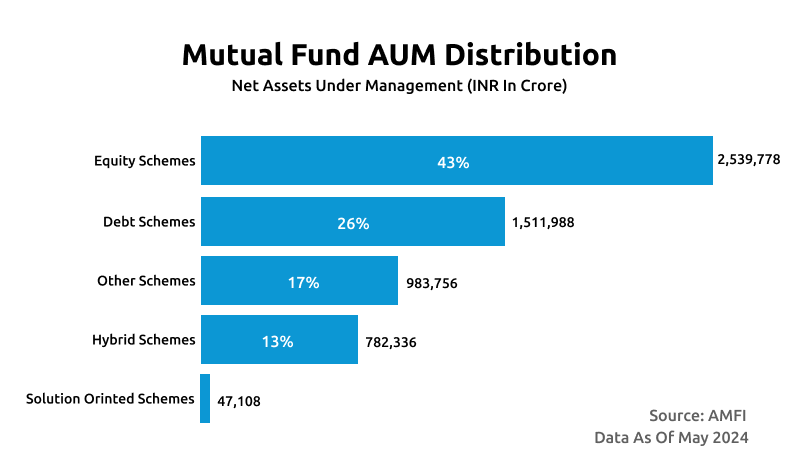

SEBI classifies mutual funds into five broad categories: Debt, Equity, Hybrid, Solution-oriented, and Others. In terms of Asset Under Management (AUM), Equity leads the pack by a mile as the most popular option among investors.

As of May 2024, the total AUM of the Mutual Fund industry in India stands at approximately Rs. 59 lakh crores. About 43% of this, Rs. 25 lakh crores is under Equity Schemes.

Types of Equity Schemes:

SEBI categorizes equity funds into 11 different schemes based on their unique characteristics and investment strategies. Here’s a brief look at the different types of equity schemes:

-

Large Cap Fund

Large-cap funds must invest at least 80% of their total assets in the top 100 companies by market capitalization. The remaining 20% allocation is up to the discretion of the fund manager and can be invested in mid- and small-caps.

Mid- and small-caps stocks saw a phenomenal rally in 2023. Consequently, the managers who allocated the remaining 20% of their funds towards them had a better chance of outperforming the market.

In 2023, the S&P BSE 100 generated a return of 23.2%, and approximately 48% of the active large-cap fund managers were able to beat the benchmark. This is considerably higher than the three- and five-year periods, where only 10-15% of the active fund managers were able to beat the benchmark. [Source: SPIVA Report 2023]

-

Mid Cap Fund

Mid-cap funds have to invest at least 65% of their total assets in mid-cap stocks—ranking between 101st and 250th based on market capitalization. These funds offer higher growth potential than large-cap funds but also come with increased volatility and risk.

They are one of the most popular options among investors, having over Rs. 3 lakh crores of AUM.

-

Small Cap Fund

Small-cap funds have to invest at least 65% of their total assets in small-cap stocks—ranking beyond 251st in terms of market capitalization. These funds have the potential of delivering significant returns but also carry high risk and volatility.

Small-cap stocks finally erupted in 2023 after a really long period of no returns. From January 2018 till April 2023, the Nifty Smallcap 100 index remained flat, yielding no returns for over five years. The tide changed in April 2023, and the index has grown by over 75% in the last 12 months.

In the past 12 months, small-cap funds have seen an influx of over Rs. 40,000 crores, and the AUM under the scheme has clocked a 76% YoY growth. Bandhan and Quant Mutual Funds were among the biggest beneficiaries of this rally.

-

Large & Mid Cap Funds

Large & Mid Cap Funds invest a minimum of 35% in large-cap and 35% in mid-cap stocks. This means 70% of total assets are invested in the top 250 companies of India.

These funds are gaining popularity among investors, registering a net influx of over Rs. 25,000 crores in the last 12 months.

-

Multi Cap Fund

Multi-cap funds invest in stocks across various market capitalizations—large-cap, mid-cap, and small-cap. This diversification helps balance the risk and potential returns. These funds must invest at least 75% of their total assets in equities, with a minimum of 25% each in large-cap, mid-cap, and small-cap stocks. The remaining 25% can be invested as per the discretion of the fund manager.

-

Flexi Cap Fund

Flexi cap funds are market cap agnostic and can invest without any predefined limits. This flexibility allows fund managers to shift their focus to market conditions and opportunities, catering to investors who prefer a dynamic investment strategy. Flexi-cap funds must invest at least 65% of their total assets in equities, but unlike multi-cap funds, there are no specific allocation limits among large, mid, or small-cap stocks. Flexi-caps are the most popular option among investors, having over Rs. 370,000 crores in AUM.

-

Focused Fund

Focused funds invest in a limited number of stocks, usually around 20-30. This concentration can lead to higher returns if the selected stocks perform well but also increases the risk if they do not.

There is no restriction on a fund’s investment—fund managers can deploy the funds in any stocks across market caps.

Focused Funds have about Rs. 130 lakh crores under AUM but have started derailing in terms of popularity. They saw an outflow of over Rs. 3,500 crores in the last 12 months, and it was the only equity scheme to register a net outflow over the period.

-

Sectoral/Thematic Funds

Sectoral funds invest in stocks within a specific sector, such as technology or healthcare, whereas thematic funds invest based on broader investment themes, like renewable energy or digitalization.

These funds can offer high returns but are highly susceptible to sector-specific risks. They are ideal for investors with strong insights into particular sectors.

Sectoral/thematic funds must invest at least 80% of their total assets in equities of a particular sector/theme.

In May 2024, we saw a record net inflow of Rs. 19,000 crores towards sectoral/thematic schemes. Reports suggest that this was fueled by heightened investor confidence due to recent strong performance.

-

Value Fund/Contra Fund

Value funds invest in undervalued stocks that have strong fundamentals but are trading below their intrinsic value.

Contra funds, a subset of value funds, take a contrarian approach by investing in stocks that are currently out of favor with the market. Contra Funds must invest at least 65% of their total assets into equity-linked products and equity derivatives.

-

Dividend Yield Fund

Typically, these funds invest around 70-80% of their corpus in stocks that have a dividend yield higher than that of the market (or benchmark). Regular inflow of dividends makes them suitable for conservative investors seeking steady returns and regular income.

-

ELSS (Equity Linked Savings Scheme)

ELSS funds are tax-saving mutual funds that invest primarily in equities. They come with a lock-in period of three years and offer tax benefits under Section 80C of the Income Tax Act, making them a popular choice for tax-saving investments.

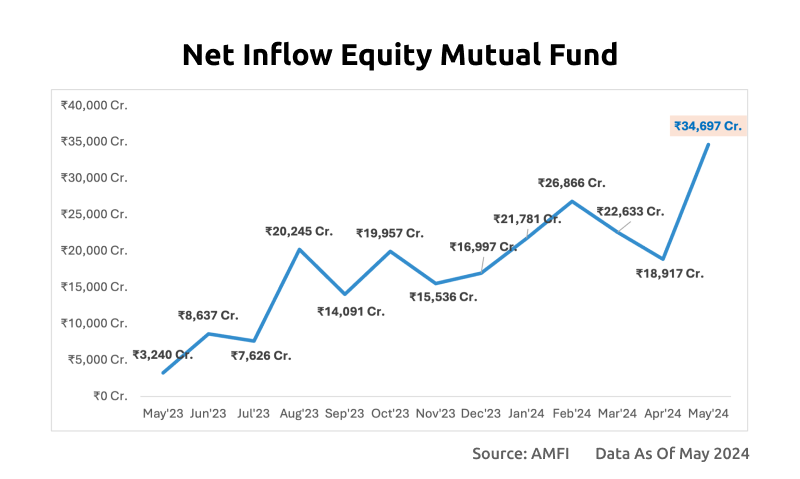

The net inflows into equity mutual funds in May 2024 reached a record high of INR 34,697 crore. This significant jump is attributed to strong market performance and heightened investor confidence. Recent reports indicate that investor sentiment has been bolstered by positive market returns and optimistic economic forecasts.

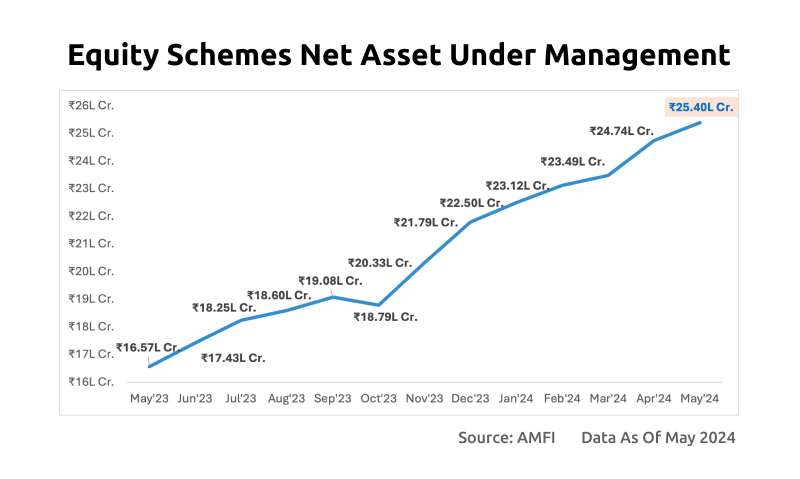

The Net Assets Under Management (AUM) have shown phenomenal growth from INR 16.57 lakh crores in May 2023 to INR 25.40 lakh crores in May 2024, a 53% YoY growth.

The rising AUM is attributed to net influx and capital appreciation. In the last 12 months, we saw a net influx of approximately Rs. 228,000 crores.

Ending Note

The mutual fund industry in India has only scratched the surface. Mutual fund assets as a percentage of GDP are still less than 20%, compared to over 100% in some developed countries. There is a significant room for growth.

According to AMFI's AUM Category-wise data, the growth in equity mutual funds is primarily driven by retail participation. As of 2023, only about 8% of India's population invests in mutual funds, with even fewer having active accounts. As retail participation increases, we can expect exponential growth in Mutual Fund AUM.

Thank you for reading!

Related Posts

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…

All Nifty Bees Are Equal — But Some Are More Equal Than Others

The title, inspired by George Orwell’s classic Animal Farm, perfectly captures the essence of this…