The Assets Under Management (AUM) of Indian Mutual Fund Industry stands at ₹57L Cr as on April 30, 2024, up from ₹41L Cr a year ago. That’s a massive year-on-year growth of 38%. In April month alone, we saw a net influx of ₹2.4L Cr. [Source: AMFI]

Indian Mutual Fund Industry has shown a lot of potential over last decade. In this blog, we are going to take a deep dive into the Mutual Fund Industry of India and understands it’s ins and outs.s.

Background & History

TThe mutual fund industry in India started in 1963 with the formation of Unit Trust of India. Since then, it has gone through incredible transformation to be the become the one that we witness today.

It is regulated by the Securities and Exchange Board of India (SEBI) and promoted by Association of Mutual Funds in India (AMFI). The role of AMFI is to work towards the growth & development of mutual funds in India and address the issues and challenges faced by the stakeholders.

Classification of Mutual Funds

On the basis of maturity, mutual fund schemes are classified into 3 categories:

- Open Ended Funds: Open ended funds allow investors to buy or sell units at any point in time directly with the Asset Management Company (AMC). Approximately 99% of the schemes are open-ended.

- Close Ended Funds: Close ended funds have a fixed maturity period, and investors can only invest during the initial New Fund Offer (NFO). After the offer closes, no new investments are allowed. If an investor wishes to sell his units, he can’t do so directly with the AMC, and has to sell them through an illiquid secondary markets often at a heavily discounted prices. This is the primary reason behind the unpopularity of close-ended funds.

- Interval Funds: Interval funds scheme on the other hand combines open-ended and closed-ended features, allowing investors to trade units at set intervals. They too are extremely unpopular amongst investors and as of April,2024 have less than ₹500 Cr in AUM.

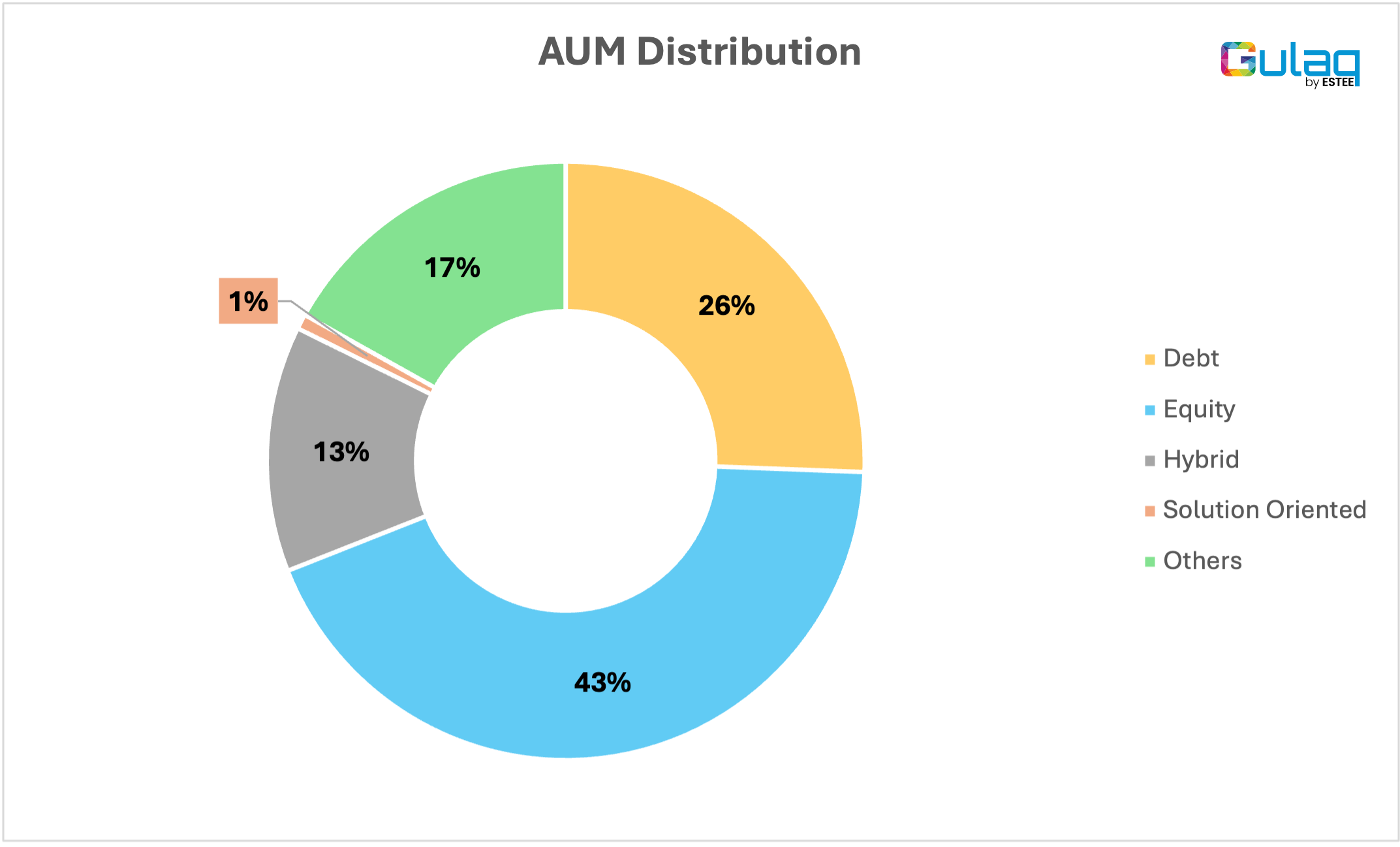

On the basis of principal, SEBI has classified a total of 36 schemes under 5 broad categories:

- Debt Schemes

- Equity Schemes

- Hybrid Schemes

- Solution Oriented Schemes (Retirement & Children’s Fund)

- Other Schemes (Index Funds/ ETFs & FoF’s)

Debt-based funds account for about 26% of the total Assets Under Management (AUM) in the industry. As of April 2024, the total AUM under debt-based funds is ₹14.6L Cr, up from ₹13L Cr a year ago, marking a respectable year-on-year growth rate of 12%. Liquid funds are the most popular among debt funds, comprising over 30% of the debt AUM.

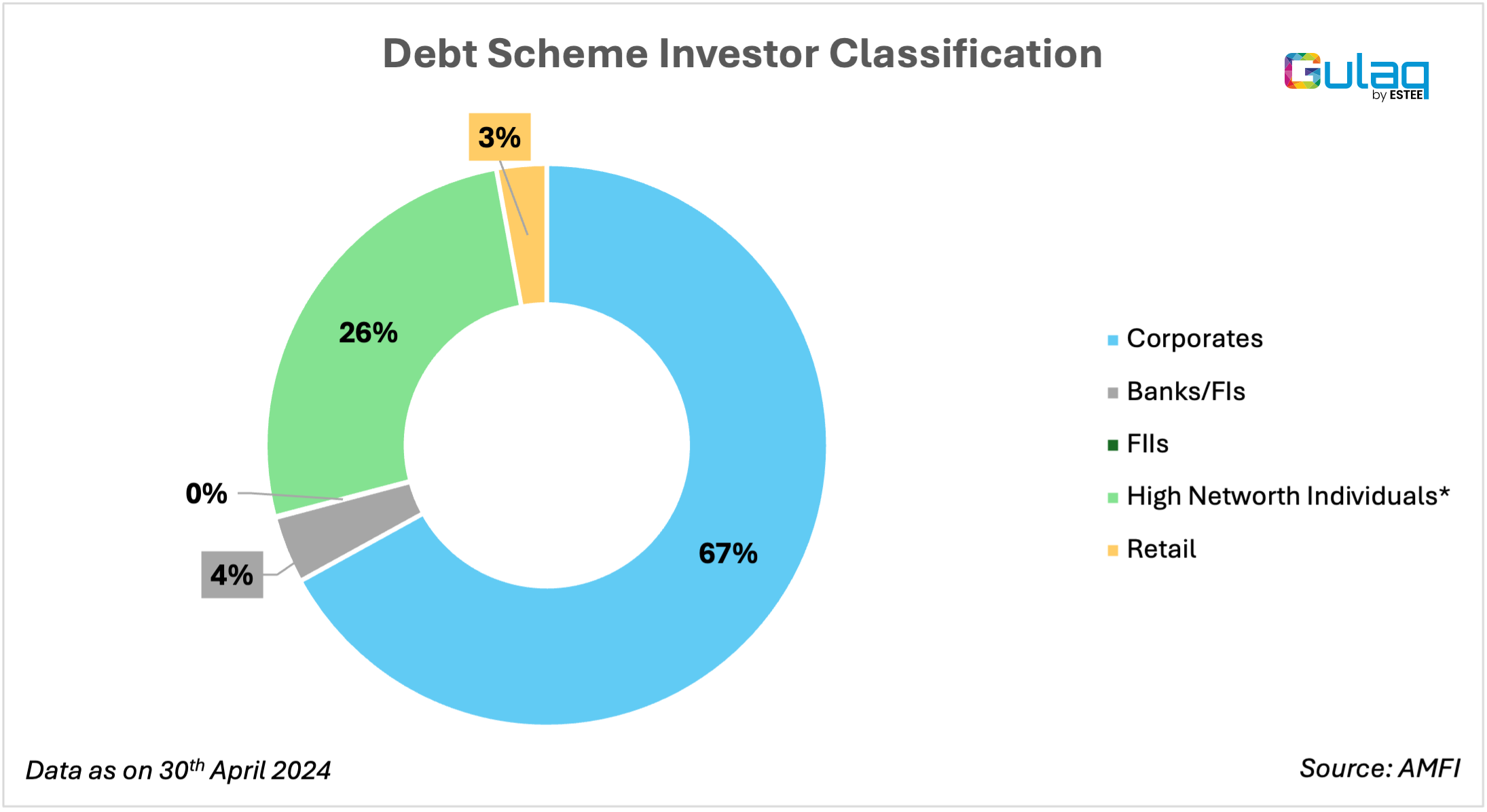

A closer look into AMFI’s investor classification data shows that more than 95% of debt AUM is held by corporates, banks/financial institutions, and high-net-worth individuals (HNIs), with minimal participation from retail investors. Even in gilt funds, retail investors contribute less than 5% of the AUM.

In April, we saw a staggering net influx of approximately ₹190K Cr in the debt-based schemes with the top gainer again being the liquid funds. This has been a trend around the financial year end where corporates trying to build up their balance sheets amidst tight liquidity situations leads to a heavy outflow in March, followed by a rebound in April. In March, we saw a net outflow of approximately ₹2L Cr.

Equity funds hold the largest slice of the total Assets Under Management (AUM) distribution.

As of April 30, 2024, the total AUM under equity-based schemes stands at a remarkable ₹25L Cr, up from ₹16L Cr the previous year, marking an impressive year-on-year growth of 56%.

Among equity funds, Flexi Cap funds are the most popular, accounting for about 15% of the equity AUM, followed by large-cap and mid-cap funds, each holding 13%.

Over the past eight months, equity-based schemes have consistently seen a net influx of over ₹15,000 Cr. In April, we saw a net influx of ₹19,000 Cr. This was primarily driven by the recent rally we saw in mid-caps and small caps.

The retail segment dominates this class, making up over 53% of the total AUM as of March 2024.

Hybrid funds combine equity, bonds, and other securities to create a hybrid portfolio. It is the third most popular category among investors after equity and debt funds. Within this class, Dynamic Asset Allocation funds & Balanced Hybrid Funds were the most popular choices amongst investors.

Hybrid funds have also experienced phenomenal growth this year. The total AUM under this category grew from ₹4.9L Cr in April 2023 to ₹7.6L Cr in April 2024, clocking a year-on-year growth of 53%..

Solution-oriented funds are tailored to address specific financial goals, such as retirement or children's education, and often feature a lock-in period to encourage long-term investment discipline. They make up less than 1% of the total AUM in the industry.

As of April 2024, the AUM for solution-oriented funds stands at ₹46,000 Cr, up from ₹33,500 crore a year ago, marking a decent growth of 37%.

Other schemes include index funds, ETFs, and Funds of Funds (FoFs). Among these, ETFs dominate the category, accounting for more than 70% of the AUM.

As of April 2024, the total AUM for these schemes stands at ₹9.6L Cr, up 34% from ₹7.2L Cr a year ago.

Ending Note

The mutual fund industry has seen remarkable growth over the past decade. The AUM has grown at a compounded annual growth rate (CAGR) of approximately 20%, increasing sixfold from ₹9.45L Cr in April 2014 to ₹57.26L Cr as of April 2024.

In terms of investor participation, the industry achieved a significant milestone in May 2021 by crossing 10 Cr (100 million) folios. By April 30, 2024, the total number of accounts, or folios, had reached 18.15 Cr (181.5 million). Of these, approximately 14.54 Cr (145.4 million) folios are under Equity, Hybrid, and Solution Oriented Schemes, where the majority of investments come from the retail segment.

Despite this commendable growth, India’s mutual fund assets as a percentage of GDP remain below 20%. In comparison, some developed countries like the United States and Australia have mutual fund assets exceeding 100% of their GDP. This gap highlights significant growth potential for India’s mutual fund industry in the coming decades.

With India’s increasing financial literacy, rising disposable incomes, technological advancements, and robust economic growth, the industry shows promising potential. As more retail investors enter the market and innovative products continue to emerge, the future of the mutual fund industry looks bright.

Thank you for reading!