Long Alpha Performance Deep Dive: 2024

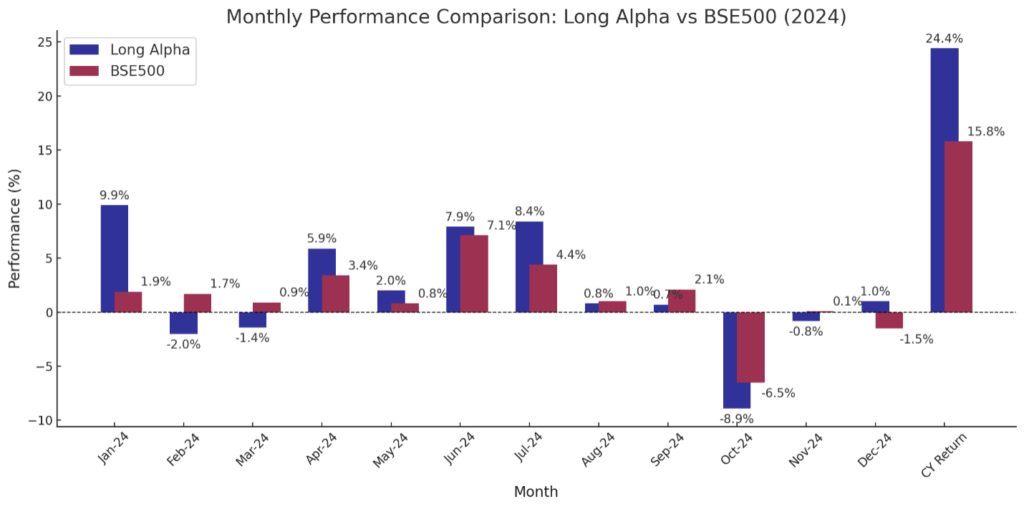

The year 2024 proved to be eventful for both the financial markets and Estee’s PMS – Long Alpha. We started the year with a bang, delivering approximately 10% return in January, significantly outperforming the BSE 500’s 2% return.

Retail investor participation was remarkable, and the year seemed promising until challenges arose in October due to heavy selling by FIIs. Despite the turbulence, Long Alpha closed the year with an impressive 24.4% return, outperforming the BSE 500’s 15.8% return, and achieving an active return of 8.6%.

As we turn the page on 2024, it is the perfect time to reflect on the performance of our portfolio, assessing what worked and where we can improve.

About Estee

Estee is a quant-driven, analytics-focused firm founded in 2008, the year algorithmic trading was permitted by SEBI in India. We have pioneered the application of quantitative strategies to investments and introduced algorithmic investment products to the Indian market.

Why Estee?

- Pioneers in quant investing in India.

- Proven performance track record.

- Trusted by over 18,000 clients (across PMS & Investment Advisory services).

- INR 1,500 crore+ in Assets Under Management (AUM).

Our Core Investment Beliefs

- Systematic, data-driven approach: Investments are governed by data and algorithms.

- No human intervention: Decisions are entirely rule-based, eliminating biases.

- Rigorous research & backtesting: Models are thoroughly tested before being introduced to investors.

- Continuous improvement: Models are updated regularly to adapt to changing market conditions.

About Long Alpha

Long Alpha is Estee’s flagship portfolio, designed to consistently outperform the benchmark equity index while maintaining lower volatility. It is a quantitatively managed fund that employs a systematic, rule-based trading model to remove human subjectivity.

Key Features:

- Focuses on the S&P BSE 500 universe, identifying investable businesses using a blend of technical and fundamental factors.

- Positions are built in top-ranked stocks based on factor scores.

- Optimized equity portfolio: Capital is allocated to maximize risk-adjusted returns.

- Dynamic management: The portfolio is regularly re-evaluated and rebalanced to maintain its edge.

Performance

As shown in the graph above, Long Alpha achieved an annual return of 24.4% in 2024, compared to 15.8% for the BSE 500. On a month-to-month basis, Long Alpha underperformed the benchmark in 50% of the months (6 out of 12); however, it still delivered a healthy active return of 8.6%.

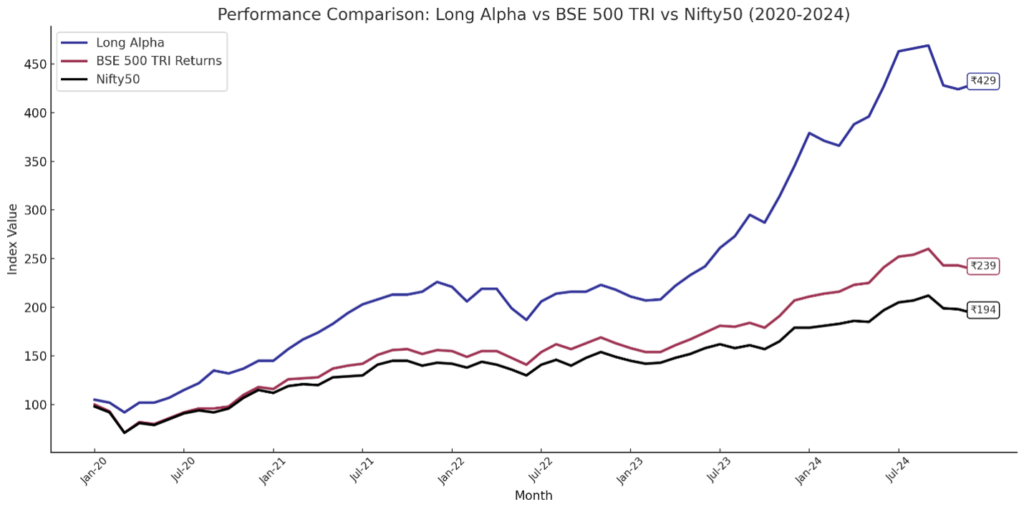

In the above line chart, you can observe how ₹100 invested five years ago would have grown in Long Alpha, BSE 500, and Nifty 50. Your investment would be worth ₹429 with Long Alpha, compared to just ₹239 with BSE 500 and ₹194 with Nifty 50.

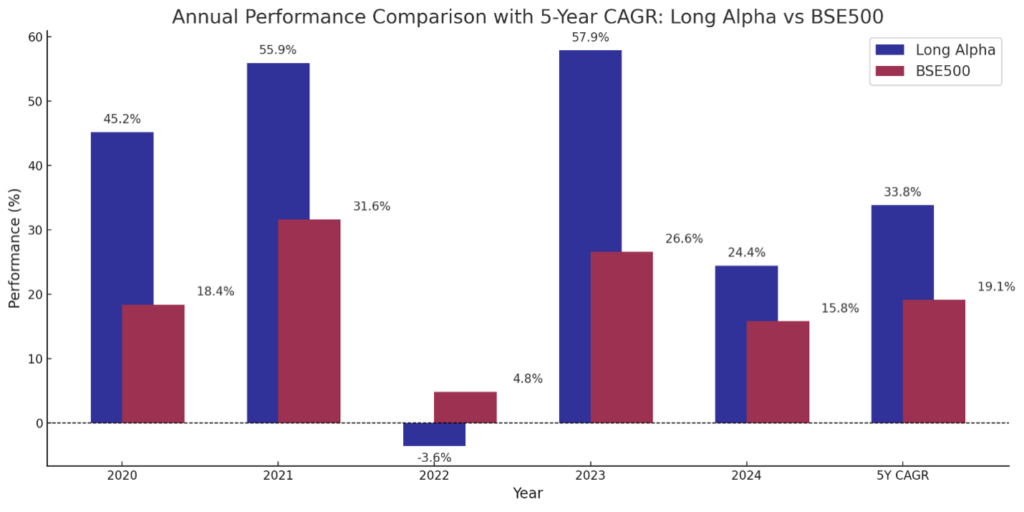

The above bar chart illustrates the annual performance of Long Alpha compared to the BSE 500. A single year is a relatively short period of time in context of a market cycle, and hence comparing longer-term performance provides a much better indication of a fund’s potential. As shown, Long Alpha has consistently outperformed the benchmark by a healthy margin, underperforming in only once in the last 5 years, with an overall CAGR of 33.8% compared to 19.1% for the BSE 500.

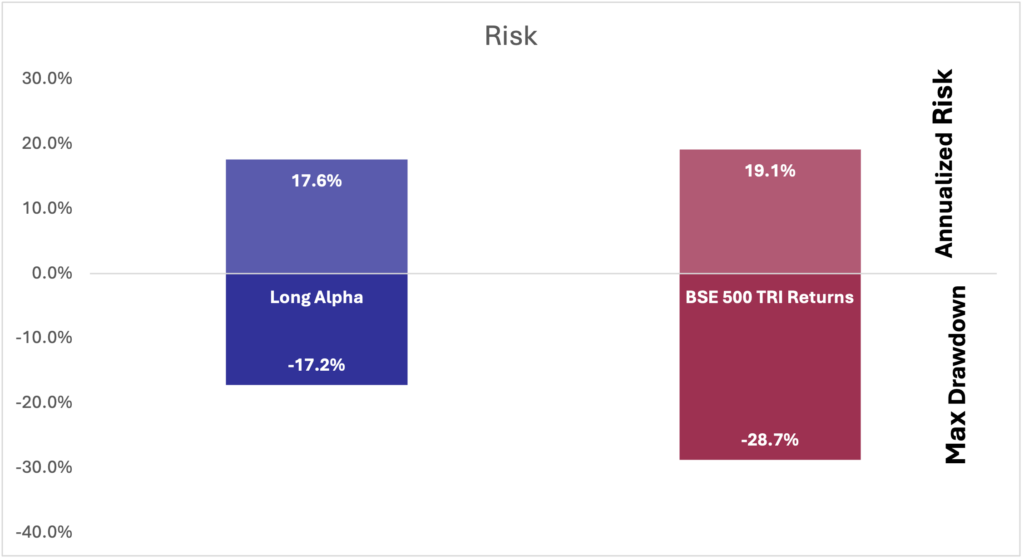

However, returns are only one side of the equation. Risk must also be considered in conjunction with returns to effectively evaluate performance.

Note:

- Annualized Risk is calculated as the annualized standard deviation over the 5-year period.

- Maximum Drawdown is calculated as the largest decline observed from peak to trough over the last 5 years.

Please refer to the attached spreadsheet for detailed calculations.

One of our core objectives is to consistently outperform the benchmark while maintaining low volatility. Despite delivering significantly higher returns, Long Alpha’s annualized risk is lower than that of the BSE 500. Additionally, Long Alpha exhibits a smaller maximum drawdown compared to the benchmark.

This superior risk-adjusted performance is achieved through our multi-factor investment methodology, which is sector-agnostic and dynamically rotates between factors to ensure the portfolio remains robust amidst changing market dynamics.

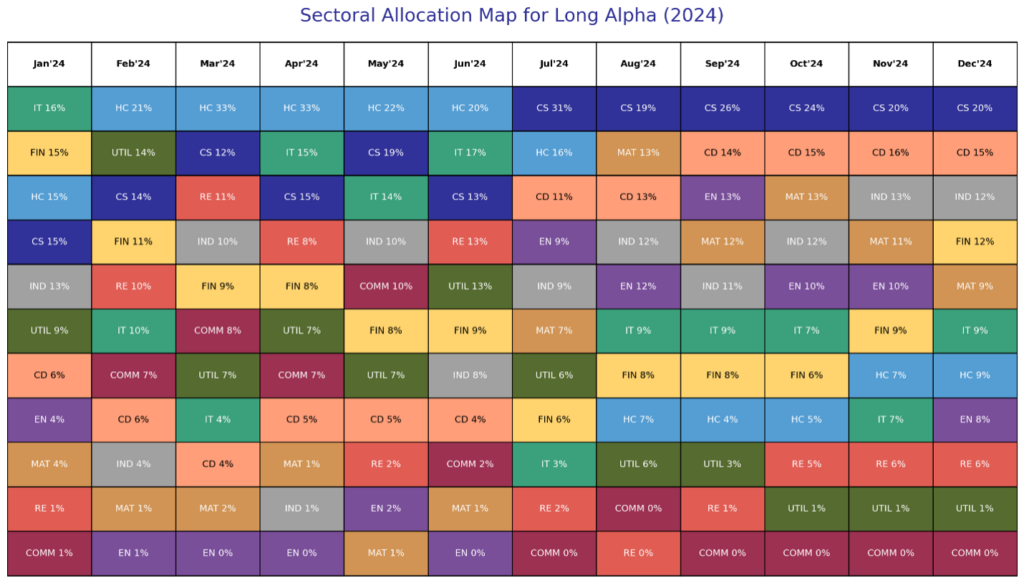

The above table highlights the sector allocation of Long Alpha throughout 2024. In constructing the portfolio, we incorporate a sectoral block that scores the investment universe based on sectors that are likely to perform well. Historically, this has been a significant contributor to our alpha.

In 2024, healthcare and consumer staples were our largest allocations; however, they did not contribute significantly to alpha generation. Instead, industrials and financials emerged as the top-performing sectors for us this year. This underscores the benefit of adopting a sector-agnostic investment approach. Predicting which sector will outperform is challenging, but maintaining a diversified exposure across sectors allows us to tactically adjust allocations and extract alpha effectively.

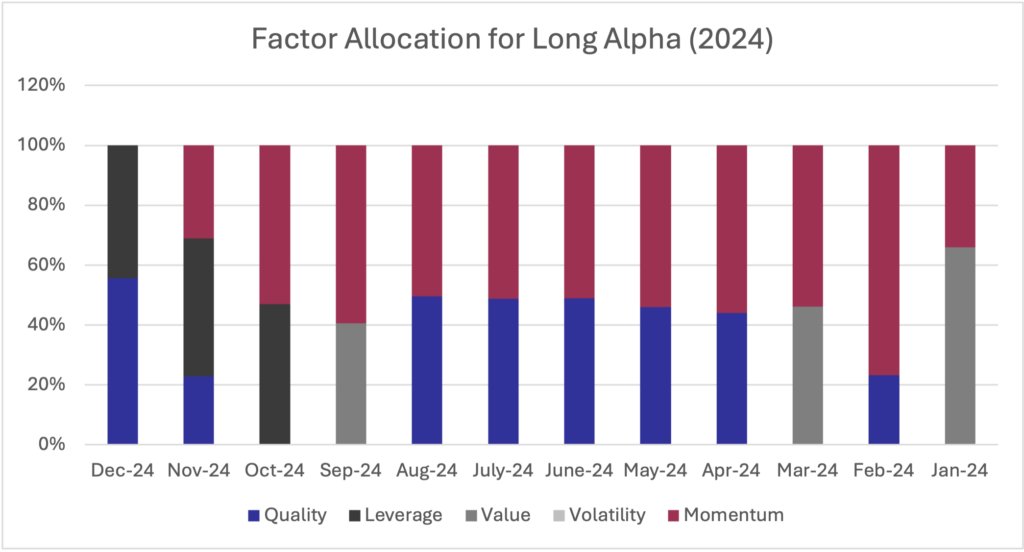

We consider over 130 factors when constructing Long Alpha’s portfolio. The above graph illustrates the broad categories of these factors. This year, momentum emerged as the biggest contributor to alpha generation for the portfolio.

Bottom Line

As we look back, 2024 is now in the rearview mirror. Long Alpha delivered a strong performance despite market turbulence. Indian investors have demonstrated an increasing appetite for data-driven systematic investing, and Estee remains committed to leading the advancement of quant investing in India.

If you’d like to connect with our team to explore how we can serve you, please reach out. Our team will guide you on getting started with Long Alpha or address any specific queries you may have.

Contact Details:

- Website: https://pms.esteeadvisors.com/

- Email: [email protected]

- WhatsApp/Dial: +91-8826408100

Related Posts

Process Matters More Than Outcome

I have spent nearly a decade of my life trading energy derivatives, and today I…

Is Market Cap the Best Way to Build an Index?

Nifty 50 is a free-float weighted index – a slight variation of market cap weighted…

3 Books That Changed How I Think About Risk and Markets

Over the past two decades, I’ve built a quiet but consistent habit — reading. Not…

All Nifty Bees Are Equal — But Some Are More Equal Than Others

The title, inspired by George Orwell’s classic Animal Farm, perfectly captures the essence of this…