Gulaq Balanced Investment Approach

Model portfolios have become a popular investment approach for retail investors lately. Investment Platforms such as smallcase, wealthdesk, etc. have allowed investment advisors to create and test their investment ideas with a collection of stocks on offer to investors. The trend led to the rise of thematic, sector specific, factor specific model portfolios. These portfolios are easier to understand for investors. However, is it a reliable approach for investors in the long-term?

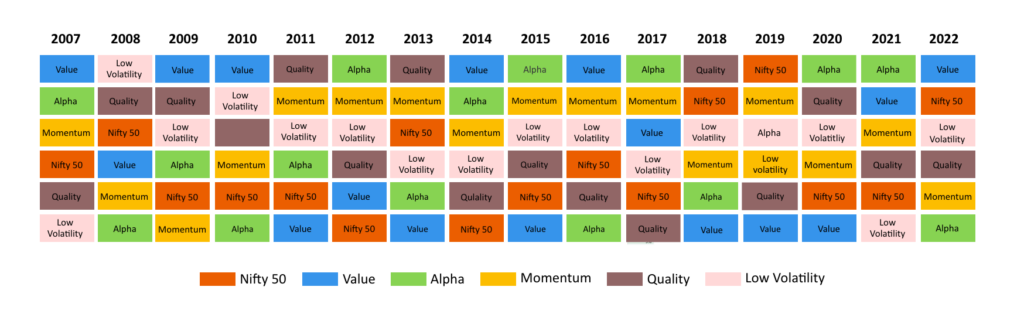

Let’s start with the single factor investing approach. Momentum investing, where stock selection is made by the signals generated by momentum factor, has grown so popular that there are even courses being offered to understand momentum as a factor. Momentum had a golden run from 2011 to 2019, but over the last 3 years the performance has gone down and dipped to the bottom in 2022. Similarly, the value factor was at the bottom for 3 straight years from 2018 to 2020, and has been a top performer during the last 2 years. Simply put, factors’ performance is as dynamic as markets’ performance. Relying on specific factor driven portfolios is likely to increase the concentration risk.

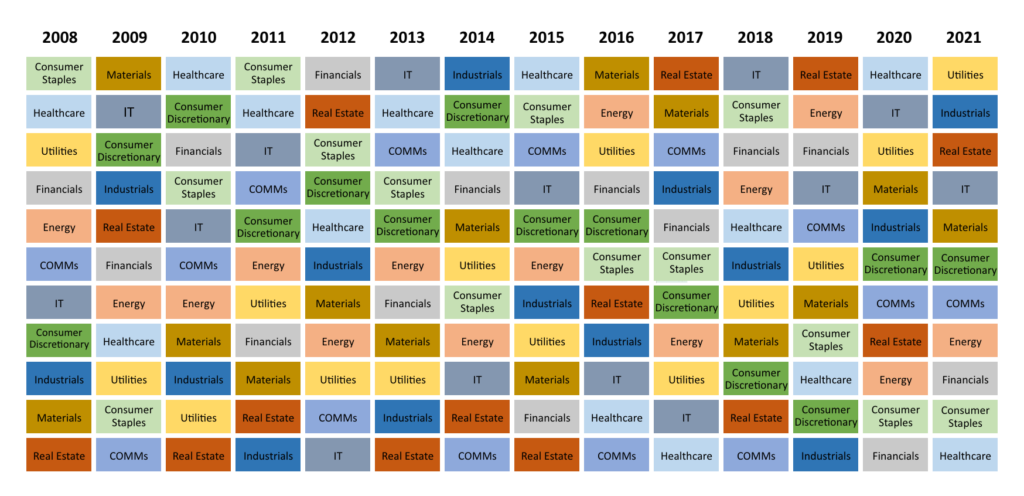

Let’s talk about sector specific bets. Investors track a specific sector which they understand and try to take positions in the same. But, is there any pattern in sector performance? Healthcare being a top performer in 2020, turned out to be the worst performer in 2021. Utilities have gained quite a lot over the last 5 years, but cyclicity can hit any time. Similar case happened with consumer discretionary (Hitting peaks and falling to bottom). There is not a clear trend about which sector performs better in a given year. Hence, taking a skewed bet in favour of a specific sector is like dealing with extreme volatile cases.

Investing in large caps is traditionally associated with stability and in small caps or mid caps with growth. This approach is relatively older compared to sector based or single factor based investing. Hence, we analysed the last 15 years’ data to see if there is a pattern in market caps performance. You can guess the answer from the chart itself. Additionally, there are 100s of stocks being part of each index which brings in selection risk.

Key challenges with skewed investing approach:

- None of the factors outperforms the Index consistently. Momentum and growth works in growing economies and value and quality works better during bear markets.

- There is no clear pattern in sector wise performance each year. There is a cyclicity in money flowing from one sector to another. A sector agnostic portfolio would limit the concentration risk and provide stability.

- Small caps don’t mean growth, and large caps don’t mean safe bets. The data clearly doesn’t support our beliefs. A multi-cap portfolio would strike a balance between growth and safety.

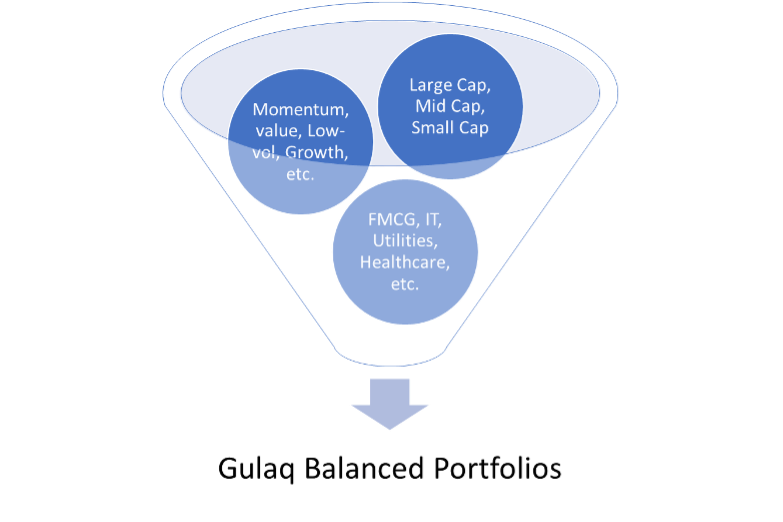

Gulaq balanced investing approach:

As illustrated in the above portfolio construction process, Gulaq portfolios track and analyse 130+ factors including fundamental, technical, and macroeconomic factors. Our Quant team has developed algorithms which digests the data and generates queues about which particular index has a better chance to grow and accordingly our portfolio weights get adjusted.

Gulaq balanced portfolios focus primarily on consistent performance with diversification across market caps, factors, and sectors. This approach helped us avoid extreme cases, and beat the benchmark consistently.

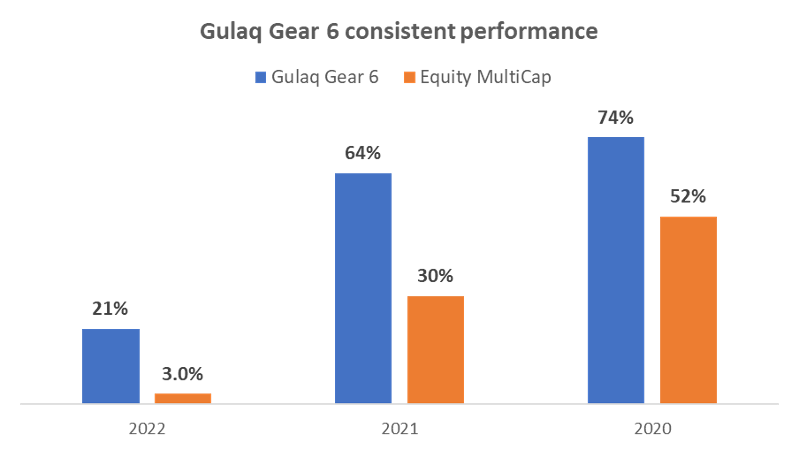

To provide a live example, let’s consider diversification across market caps. In 2020 and 2021, when the smallcaps and midcaps were having golden run, Gulaq Gear 6 had close to 70% allocation in these two indices. In 2022, Large cap alone had 50% share in the portfolio.

Our flagship portfolio, Gulaq Gear 6, has outperformed benchmark consistently across different market cycles. The secret sauce of this outperformance is our balanced investment approach. The following graph shows how Multi-factor based Gulaq Gear 6 has performed compared to Nifty Multicap index.

The balanced investment approach is the core aspect of Gulaq portfolios. The approach has helped us minimise concentration risk and improve risk-reward ratio. We have written blogs explaining in-depth about the performance of Gulaq Gear 6 portfolios (available in the blogs section). In the informative age where influencers make claims on multibaggers, we want to remain focussed on sustainable long-term wealth creation for the investing community.

Related Posts

Tax Harvesting: How to Reduce Your Tax Burden?

FY 23-24 has been great for Gulaq. We were able to generate phenomenal returns for…

Don’t Miss the Forest for The Trees: Why Maxing Out the Rs. 1.5 Lakh Limit on Your PPF Before 5th of April Is Not Worth the Hype

As the financial year has ended, the buzz around investing the entire Rs. 1.5 lakh…

Why Active Fund Investing is so hard?

Would you consider investing in a fund that has significantly trailed its benchmark over the…

Halo Effect can be Dangerous to your Portfolio!

Charlie Munger once famously said, “It is remarkable how much long-term advantage people like us…